Chubb Limited 2023 Letter to Shareholders

Evan G. Greenberg

Chairman and Chief Executive Officer | Chubb Group

In This Letter

To My Fellow Shareholders

Chubb produced another year of record financial results in 2023. All divisions of the company contributed to our growth in operating income, which topped $9.3 billion, up 45%, with operating income per share up 49%. Operating income was double the amount from pre-COVID 2019. Three sources contributed to this growth – property and casualty (P&C) underwriting income, investment income and life insurance income – and each delivered new highs in operating performance.

We benefited one time from Bermuda’s new income tax law, which added about 12% to earnings. Without this, core operating income was $8.2 billion, up 28%, and again a record.

We had another year of double-digit consolidated premium revenue growth, which reached $57.5 billion, up nearly 40% from three years ago. We continued to capitalize on favorable commercial P&C underwriting conditions around the world while growth accelerated in our global consumer businesses, supported by global non-life accident and health (A&H) insurance, North America high-net-worth personal lines, and our Asia life insurance business, which is also mostly supplemental A&H and risk products.

At our core, we are an underwriting company, dedicated to the art and science of taking risk. We have outperformed the industry in the craft of risk-taking for 20 years, and last year was no exception. We once again achieved industry-leading underwriting profitability with $5.5 billion in underwriting income and a record combined ratio of 86.5%, which is a real trick given our size and global breadth and speaks to our management, culture, and underwriting governance processes.

On the invested asset side, we are predominantly fixed-income investors, and we capitalized on our strong liquidity, higher rates and widening spreads while maintaining an average “A” rating. Adjusted net investment income grew 33% to $5.3 billion.

We advanced a number of our longer-term strategies that position us for future revenue and earnings growth, including attaining after 20 years of effort a significant majority stake in Huatai Group in China, a holding company with life, non-life and asset management subsidiaries. Over the longer term, Huatai should contribute meaningfully to revenue and earnings growth in both our life and non-life operations.

We are continuing to invest in our competitive profile to ensure future value creation. As I look forward, I am confident in our ability to continue growing operating earnings and earnings per share at a superior rate through the combination of P&C revenue and underwriting income, investment income and life income.

An organization built for purpose and value creation

Let me begin as usual by giving you, our owners, a view of who and what the company you are invested in is all about. The characteristics and features come together to create what I believe is a company synonymous with quality, an ambitious and enduring organization built for purpose and value creation.

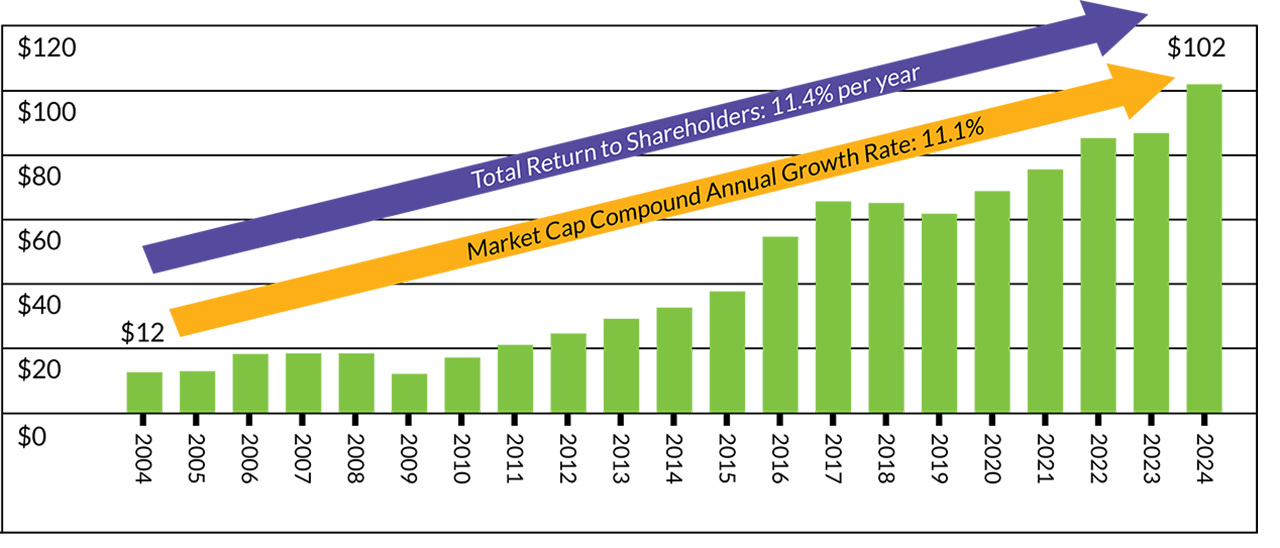

Chubb is one of the largest insurers in the world as measured by our market capitalization of more than $100 billion as of this writing. Since 2013, we have tripled our market cap, reflecting our scale and income-generating power. When I became CEO, our market cap was about $12 billion. We have grown market cap since by more than 11% per year. We achieved this not simply by getting larger, but, more importantly, by delivering value to shareholders. Our total return to shareholders over the same period, measured on a per-share basis and including dividends, grew similarly at 11.4% per year, outpacing the S&P 500 at 9.9% and the S&P 500 P&C Index at 10.2%.

Chubb Market Capitalization

From March 1, 2004 to March 1, 2024

in billions of dollars

We are global and well diversified with a deep local presence in 54 countries and territories, a true insurance multinational – one of only a few in the world – and we see a lot of room to grow over time. We are well integrated with a thoughtfully constructed portfolio of top-performing, multibillion-dollar businesses with substantial scale and potential for growth. Many are clear market leaders. While we are the largest commercial P&C insurer in America, 60% of our total company premium revenue originates outside our North America commercial division. About 30% of our global commercial P&C business and almost 50% of our global consumer P&C business is outside the U.S., and both have been growing quickly.

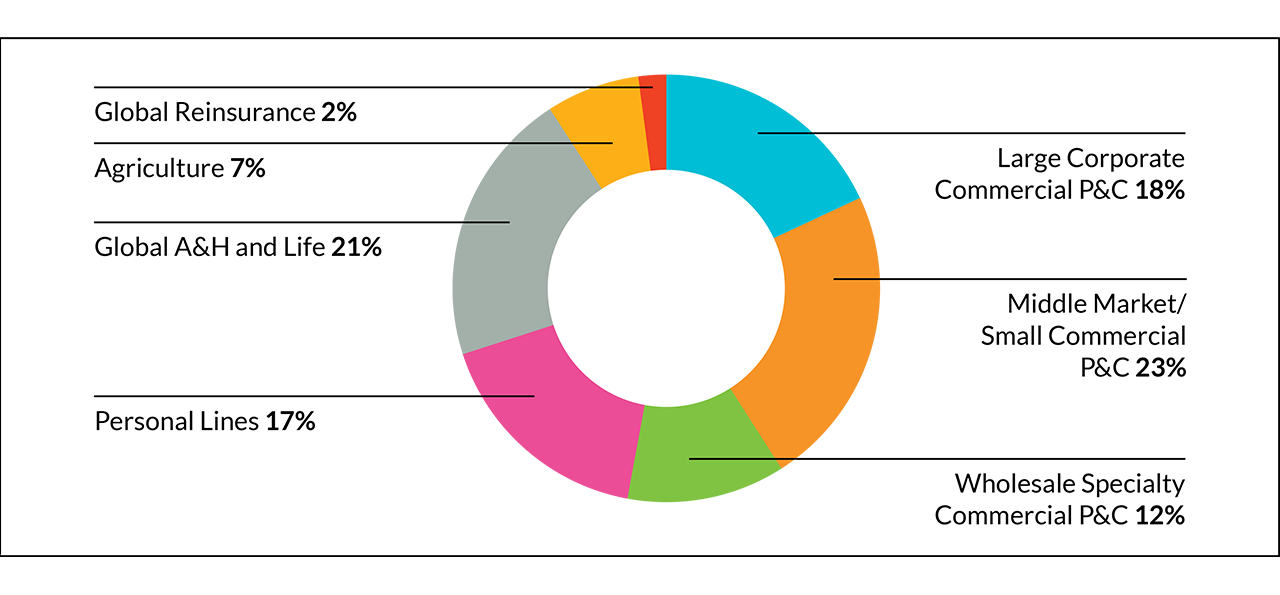

We have a well-balanced mix of business by customer and product. About 62% of our revenue and earnings globally comes from insuring businesses, where we serve the smallest to the largest companies with more than 200 different property and casualty-related products, and 38% comes from insuring individuals. We insure people’s lives and their health as well as the things they own – everything from autos to homes and their contents to the gadgets they own. Our business insuring high-net-worth individuals in the U.S. is core to our brand recognition for quality.

By design, we market through an extensive range of distribution channels to reach the target buyer most effectively. In addition to being a vital partner of the largest global brokers, our distribution network spans 50,000 brokers and independent agents, hundreds of thousands of exclusive life and health agents, and hundreds of direct-to-consumer partnerships that give us access to hundreds of millions of existing and potential customers through digital, phone and face-to-face sales. We are, in fact, the largest direct marketer of insurance in Asia, and one of the largest in the world, through both digital and telemarketing channels.

Culturally, we are builders with a clear vision. Over the past 20 years, we have grown organically first and then added complementary acquisitions that advanced our strategy further. Few companies in any industry have our record of successfully acquiring and integrating businesses while at the same time building organically. We are hungry, results-focused and maniacally execution-oriented, with a relatively flat management structure that enables rapid decision-making and oversight, combined with a rigorous governance process to ensure discipline and consistency. We have consistently focused on talent management, patiently grooming over many years a deep, multi-generational leadership bench that is of our culture and brings decades of experience to bear, ensuring continuity of standards and knowledge for a long time to come.

The result is an enviable long-term track record of financial outperformance, including growth in earnings, tangible book value and book value, underpinned by distinguished underwriting and investment results.

Another year of underwriting outperformance

Last year was another above-average year in the U.S. and around the globe in terms of natural catastrophes (CATs) and one of the costliest on record for the insurance industry. Global insured losses from CATs exceeded $100 billion for the fourth consecutive year, above the 10-year average. The absence of a single, major insured CAT event globally was striking. A frequency of severe convective storms, e.g., tornadoes and thunderstorms, accounted for $60 billion of industry losses – an all-time high.

Exacerbated by climate change and urbanization, the industry and society face a growing frequency of costly CATs from a variety of perils. For Chubb, our total pre-tax CAT losses in 2023 were $1.8 billion, which, ironically, was below our expected losses – a mathematically derived number that by definition is always wrong and simply represents an expected average over time. In truth, it was the other side of volatility, and we were simply lucky.

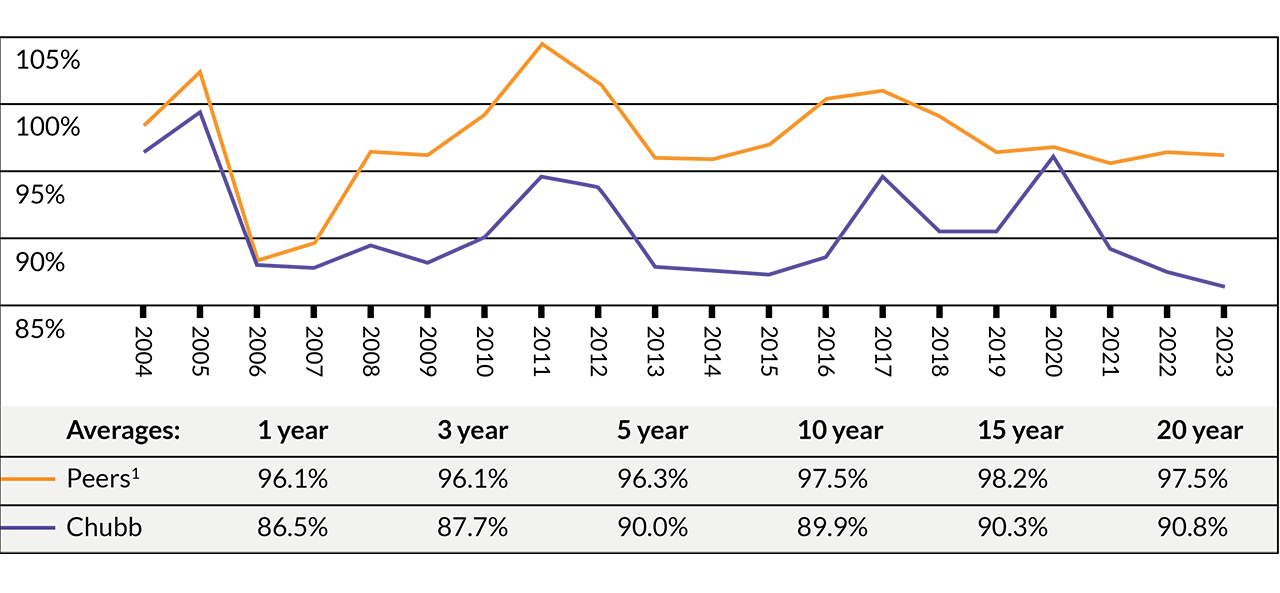

Chubb’s underwriting performance last year was exceptional. As you can see from the nearby chart, our underwriting margin surpassed the average of our peers by almost 10 percentage points; over the past 10 and 20 years, the outperformance has been about eight and seven points, respectively. As a secondary measure of underlying health, our current accident year combined ratio excluding catastrophe losses, which strips out the volatility of CATs and claim reserve movement, was 83.9% – a record low. As we and other insurers become more CAT-levered by writing more property insurance business, of course, this ratio drops. You well know my view: The best measure for investors is the published calendar year combined ratio, which includes CATs and reserve movement. Volatility of margin and income is a feature of a company in the risk business.

The most important part of our balance sheet is our loss reserves, which back our liabilities and stand at $80 billion. We have always managed our reserves conservatively. In terms of loss development, we recognize bad news early and are slow to recognize favorable development. As I have said for years in this letter, insuring casualty is not for optimists. Our current reserve adequacy is as strong as I can remember.

Favorable conditions for both commercial and consumer lines, but beware of risk

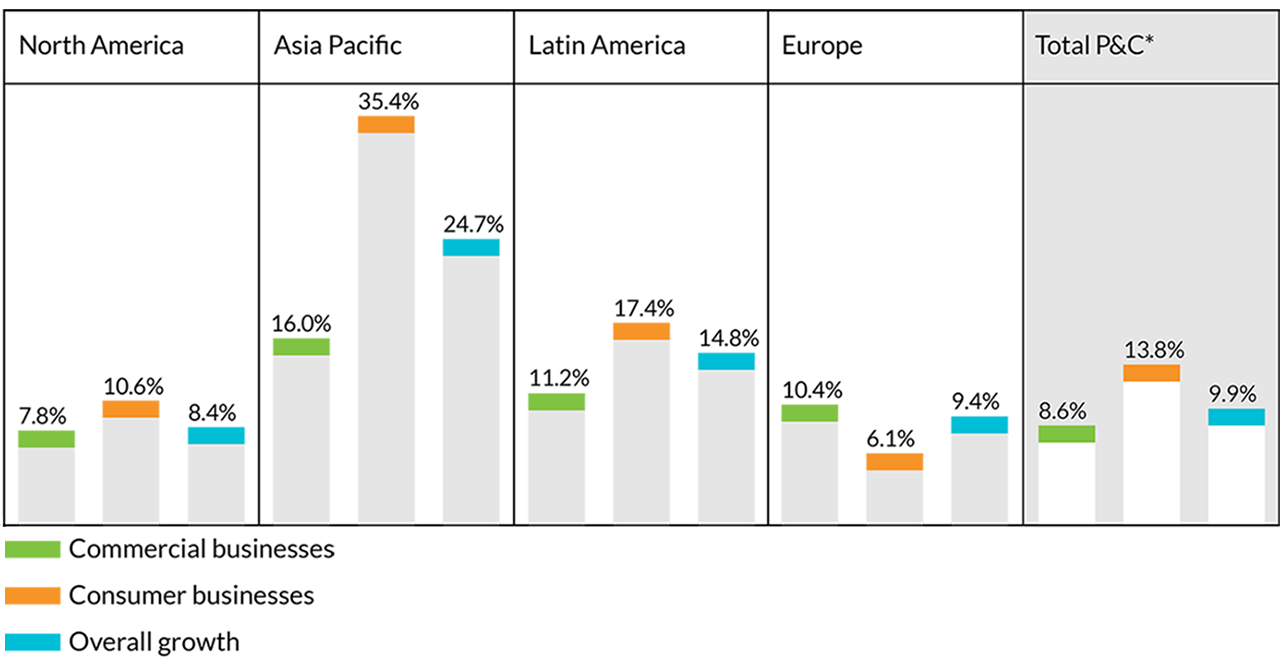

For the year, commercial P&C underwriting conditions were broadly favorable around the globe and prices, in aggregate, increased at a faster pace than loss costs. My colleagues who lead our $39.7 billion global commercial P&C business – of which, again, two-thirds originates in the U.S. and one-third is international – did a great job capitalizing on these favorable conditions and produced net premium growth of 8.6%. Since 2019, we’ve grown our commercial P&C insurance business by about 50%.

Loss-cost inflation is a reality, both property-related and especially liability-related, and remains elevated, particularly in the U.S., due to a combination of societal attitudes toward business and a money-making litigation industry that is becoming more global. Lawyers seeking plaintiffs under the guise of Robin Hood righting a wrong have increased their advertising on billboards and the airwaves: About 800,000 television ads for litigation ran last year. The frequency of severity of liability losses, i.e., large liability awards, continues to increase, especially around anything with wheels. Think commercial fleets, transportation and logistics. Casualty loss-cost inflation also comes from other powerful sources that create new exposures, such as advancements in technology and science or new laws. Lately, we have forever chemicals, responsibility for climate change and climate disclosures, and cyber-related privacy exposures, to name a few.

Of course, there is plenty of appropriate litigation brought to truly address a wrong, but then there is excessive litigation, which is a tax on the economy, business and innovation. In total, litigation costs are estimated at about 2.1% of GDP – a major tax on society and innovation. Ultimately, the business community needs to band together, pool resources and take the lead in driving reforms if we are to bring costs down. The insurance industry is hardly the right constituent to lead the change: As an industry, we don’t garner much sympathy. However, we are actively seeking out and supporting efforts to address reforms at a state and local level, advocating for changes such as those around joint and several liability laws or mandatory disclosure of who is funding a lawsuit so juries and judges can see the true motivations for many suits and requests for award.

In the meantime, we will underwrite casualty with the legal environment as we know it. That means at times shedding revenue when we can’t make a profit, which is a strength and, in fact, leads to improved profit margins and income growth for Chubb – the opposite of how some uninformed sell-side analysts at times simplistically perceive our business. In this business, choosing to shrink at the right moments is a strength.

Growth in our $19.4 billion global consumer lines operations accelerated in 2023, with strong results in both our consumer P&C and life insurance businesses. In the U.S., the results were driven primarily by our high-net-worth personal lines business, which experienced the best growth in recent memory, and in Asia from growth in our A&H division. Total company consumer premiums increased 24%.

Record financial performance in ‘23

Again, our financial results were simply outstanding with numerous records achieved:

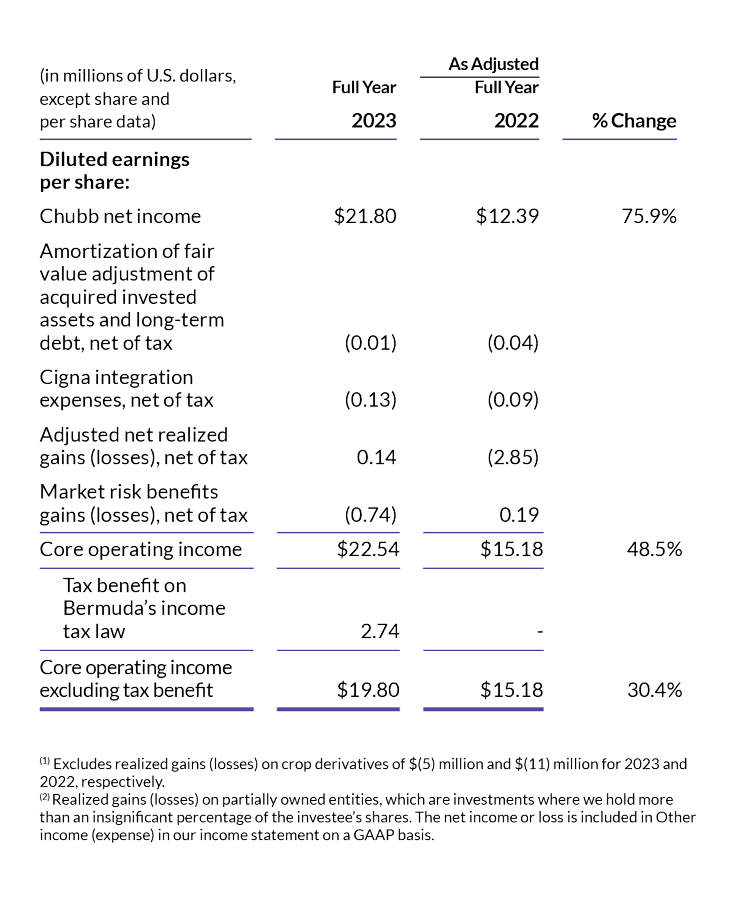

- Core operating income was $22.54 per share, up 49% compared with 2022 – and without the one-time tax benefit I mentioned earlier, it was $19.80 per share, up 30%. Either way, our operating earnings and per share were a record result. As you know, our preferred means of growing earnings per share is by investing in and growing the company and not shrinking our way to greatness through excessive capital management.

- Total consolidated net premiums written, which are the premiums we retain on our balance sheet, were $47.4 billion, up 13.5%. P&C net premiums grew 9.9% to $41.9 billion, while Life Insurance premiums and deposits grew more than 30% to $7.1 billion.

- P&C underwriting income of $5.5 billion was up 20%, driven by growth in revenue and margin.

- We have been slowly building our Life Insurance business for more than 15 years, and life income for the first time exceeded $1 billion, up 59%.

- We invested a record amount of cash and even accelerated portfolio turnover to raise more money to take advantage of higher interest rates and widening spreads, and we began to extend duration. Investment income increased to a record $5.3 billion, up 33% over prior year, and will continue to grow without a change to our portfolio risk profile.

Insurance is a balance sheet business, so we measure wealth creation by growth in tangible book value and book value. I firmly believe long-term tangible book value growth is the best measure of economic value creation for a few reasons. Tangible equity is our most constraining factor when it comes to growth, and we cannot pay claims out of goodwill. For the year, book and tangible book value per share increased 20.5% and 21.3%, respectively.

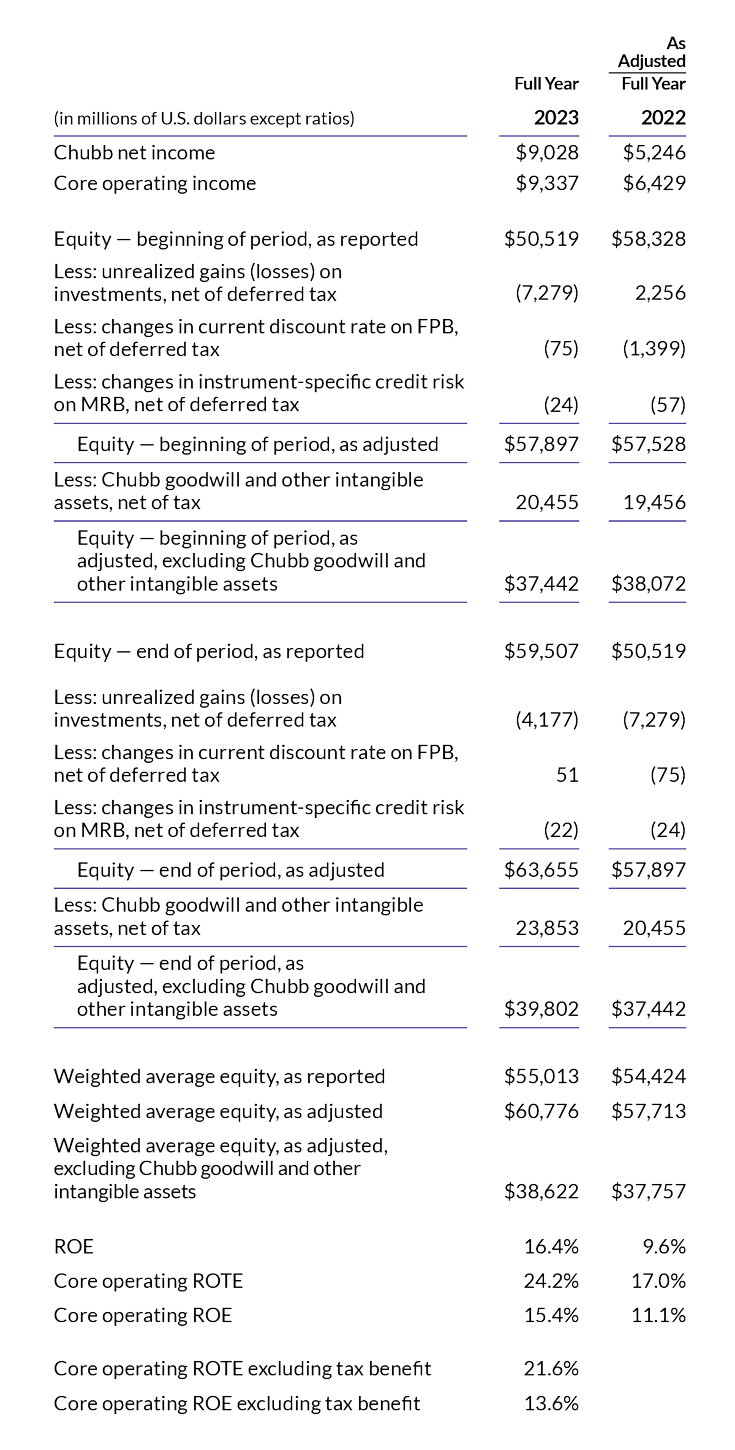

Our core operating return on equity (ROE) and core operating return on tangible equity (ROTE) last year were 15.4% and 24.2%, respectively. Without the one-time tax benefit, our core operating ROE and core operating ROTE were 13.6% and 21.6%, respectively. All of these are well in excess of our cost of equity capital, which is around 8.5%, so we are creating a lot of value for shareholders.

P&C Combined Ratio Versus Peers

The company’s underwriting results have outperformed the average of its peers over the last 20 years.

1 Includes AIG, ALL, CNA, HIG, TRV.

Source: SNL and company disclosures

For an ambitious and acquisitive company such as Chubb, ROE and ROTE are distorted by purchase accounting requirements, which employ accounting theory that, frankly, distorts the true economic returns derived from an acquisition. In Chubb’s case, these distortions scrub about 50 basis points on average from our ROE and about 75 basis points from our ROTE. Let me provide a simple, common-sense example of what I mean by distortion, which arises from the treatment of intangible assets – including what’s called VOBA, which stands for value of business acquired – when one buys a life business.

Typically, an in-force insurance portfolio that we are acquiring produces substantial future earnings, a key rationale for the transaction. Purchase accounting requires the acquirer to record the entire present value of those earnings as an asset and amortize it over time. A profitable book of business like our recent Cigna acquisition leads to a higher asset value and, ironically, results in a higher amortization charge, making the acquired business look less profitable than it was when owned by those we bought it from. Those intangibles depress our ROE.

Another example: We are forced when we purchase a commercial P&C company to ascribe a portion of the purchase price to the brokerage relationships that were the source of the business and amortize that over a defined period as if it’s an asset with a diminishing value. Pure theoretical nonsense. A better measure of ROE and ROTE recognizes and transparently adjusts for these distortions.

We expect to continue generating an ROE in the range of 13%+ and a tangible ROE of 20%+ on a published basis, and then add 50 and 75 basis points to whatever we publish for a better economic view.

Why our excess capital deserves to be valued at a premium to book value

We have told you for many years that our policy is to hold excess capital for both risk and opportunity, and that has served you well. That excess capital has created, on average, a drag on ROE of 1-2 percentage points depending on the period and how much we are holding. We would rather have some modest dilution to our ROE from holding excess capital and improve our accretion when used for an acquisition. We are constantly evaluating opportunities to deploy this cash, but we are patient and disciplined. An acquisition must meet our standard of return and must advance the strategy we are already pursuing organically. We have spent $47 billion on M&A over the past 15 years. The internal rate of return (IRR) on our cash from M&A has been 16% – almost double our cost of capital. Therefore, it stands to reason that if you think we are good stewards of capital, then our excess capital should be valued at a premium to book value.

In our company, independent of annual budgets, we prepare a rolling five-year plan. I introduced the process almost 20 years ago. Looking back, it’s stunning how close our actual results have been over the years relative to what we imagined in the five-year plans – some up, some down, but over time pretty close. I must admit, though, that the path to how we got there was sometimes wildly different than what we had imagined. This leads me to the simple notion of intrinsic value of the company. We have a pretty good sense of ours. Our intrinsic value is substantially higher than our current share price, and the beauty: That’s intrinsic value at a moment in time. If we are doing our job, it is continuing to increase over time. Chubb remains a bargain hiding in plain sight.

Next to our people, the balance sheet is our most important asset. We have $74 billion in total capital – double what we had 10 years ago and nearly seven times our $11 billion total of 20 years ago – and our equity capital was $60 billion at December 31. Our company is rated AA by S&P and A++ by AM Best.

Capitalizing on a broad set of growth opportunities

In previous years’ letters, I described in detail every major division of the company. This year, I’ll give you more of a summary by region, including key strategies and the growth outlook going forward. (If you want the description of each division, please revisit last year’s letter.)

Chubb has approximately 40,000 employees and more than 1,100 offices in the U.S., Europe, Asia, Latin America and other parts of the world. We operate our insurance business under two principal P&C divisions – North America Insurance and Overseas General Insurance – and a Life Insurance division, which is basically Asia and North America. Given our breadth of local market presence and capability, we are well positioned to continue capitalizing on a broad set of growth opportunities globally.

North America Insurance comprises our commercial and consumer P&C divisions in the United States, Canada and Bermuda, which together write $35.0 billion in gross premiums annually. Chubb is the largest commercial P&C insurer in the U.S., and we serve all sizes of companies. We are the #1 insurer for large corporations, #2 for middle market companies, a top excess and surplus lines (E&S) writer, and the largest crop insurer in America. On the consumer side, we are the #1 writer of personal lines coverage for high-net-worth individuals and families. Capitalizing on favorable market conditions for underwriting and a resilient U.S. economy, North America Insurance had an excellent year in 2023. Net premiums grew 8.4%, with commercial lines up 7.8% and personal lines up 10.6%.

Our international P&C business, Overseas General Insurance, wrote $15.7 billion in gross premiums last year with major commercial and consumer operations. We have 500 branch offices in 51 countries spread across Europe, Asia and Latin America. We insure more than 12,000 multinational and large domestic companies around the world, and a third of our mid-market and small commercial business is outside the U.S. Our local presence gives us the ability and opportunity to compete for business in the local marketplace. It provides us with local insight and data, and it allows us to reach and service customers. The deeper we get in each market – it’s iterative and takes time – the more the opportunity grows. Our international commercial business represents a major growth opportunity for us.

On the consumer side, we are one of the largest supplemental A&H writers in the world – a $7.5 billion business for Chubb written through both our non-life and life companies – and we have a meaningful international personal lines business underwriting everything from autos to homes to cell phones. Last year, international P&C net premiums written grew 13.7%, with commercial lines up 11.2% and consumer lines up 17.8%, led by Asia.

Looking ahead, commercial P&C underwriting conditions remain broadly favorable around the globe, and pricing continues to exceed or keep pace with loss costs in most of our major product areas. I am confident we will continue to capitalize and produce strong above-trend annual premium growth.

Property insurance has been a growth opportunity for us given favorable risk-reward underwriting conditions globally. With the growing impact of climate change, its related costs and volatility; reinsurers charging appropriately for risk and, in large part, passing all but the CAT tail risk back to primary companies; and the cost of money no longer zero, thus keeping alternative capital honest, favorable property insurance underwriting conditions in most areas of the world should endure. After all, inadequacy in property pricing shows up quickly.

Our company has become more property- and CAT exposure-levered. Property business is the best-priced business in the world right now, and as long as we are paid adequately, we have the balance sheet to take greater concentration and volatility in earnings from property.

In commercial lines, casualty conditions overall have been favorable, but it is an underwriter’s market, and we are more selective depending on the type of casualty client, class and territory. We have the data and years of experience to distinguish those areas where pricing and terms are attractive and where they are not. As important, the environment for casualty is dynamic and constantly evolving. To be successful requires proactive management that is quick to recognize changes, adapt pricing and terms for the future, and adjust held reserves for the past if necessary.

We are one of the largest, if not the largest, underwriters of financial lines coverage in the world, including directors and officers (D&O) – public and private, errors and omissions (E&O) for a variety of professional risks, employment practices liability insurance (EPLI), and cyber. We are a global leader in this business with years of experience and lots of data, and we see opportunities for growth globally. The big exceptions: important areas of D&O and EPLI that are simply underpriced. Frequency of securities class actions is rising at both the federal and state levels, and severity is increasing. EPLI awards are growing in size. As usual, the naive or ignorant capital and underwriters chasing this business at inadequate terms will get burned, and then pricing and terms will correct. At that time, clients and brokers will complain about inflated D&O prices, but they are happy to take advantage of soft pricing while it lasts. The same is true for certain underpriced areas of cyber.

New cybersecurity rules: an overreach

Cyber insurance is a dynamic and emerging risk and, therefore, an opportunity, and Chubb is one of the largest writers of this business. As polls show, cyber incidents rank as a top risk for businesses globally and for companies of all sizes. Cyber threats are growing as nation-state attackers and common criminals alike intensify strikes to steal information, hold companies for ransom and disrupt commerce. Our response to increasingly sophisticated cyber threats across the globe is a combination of improved threat detection and risk mitigation services, incident response services, and underwriting tools that allow us to discern sound cybersecurity standards and resiliency on the part of organizations seeking coverage. But while our capabilities improve, artificial intelligence is now creating an arms race between bad actors and the cybersecurity industry. Threats are growing, and the environment is becoming more complex.

Last year, the U.S. Securities and Exchange Commission (SEC) adopted new rules that require companies to disclose material cybersecurity breaches within four days. This is a bad idea. It compromises a company’s ability to manage a delicate event by unnecessarily increasing pressure through forced disclosure that impacts its share price while the event is still in progress. It puts unnecessary pressure on companies to settle with attackers and, while the company is remedying the breach, the disclosure gives a potential roadmap to other bad actors to exploit similar software vulnerabilities in other companies. It essentially takes one problem and creates two, putting directors and officers in a difficult position as they try to balance SEC compliance against additional harm to their company from premature disclosure of a serious cybersecurity incident. Unwise.

Going a step further, the SEC recently expanded its enforcement powers by claiming a company failed to maintain its internal accounting controls as a result of a cybersecurity incident. While it is unclear whether the SEC’s unprecedented move will survive a legal challenge, the expansive new rules and enforcement claim, in my judgment, are an overreach, reflecting both a poor understanding of cybersecurity and an intrusion on the cybersecurity responsibilities of other government agencies.

Rain and Hail: a terrific company run by great people

Returning to our North America business results, last year was another below-average year for our multi-peril crop insurance business, where Chubb is the #1 writer in America through our Rain and Hail affiliate, a terrific company run by great people providing a valuable service to American farmers. Growing conditions for crops were challenging last year, but we still produced a 95.4% combined ratio and earned $146 million in underwriting profit, so not bad.

Crop insurance is a CAT-like business, by its nature vulnerable to weather volatility, but with very good risk-reward dynamics. Crop insurance has been a great business for Chubb. Since fully acquiring Rain and Hail in 2010 for $1.1 billion, we’ve earned almost $2 billion in operating profit with an IRR of 26%.

Chubb Personal Risk Services: the gold standard

In North America, our $6.7 billion Chubb Personal Risk Services (PRS) business – the clear market leader and gold-standard franchise in high-net-worth personal lines with more than 60% market share among high-net-worth writers – produced its best growth in 20 years. I couldn’t be prouder of our team of professionals who work every day to support our clients.

To provide needed coverage at appropriate terms, we are writing more homeowners business through our E&S entities on what’s called a non-admitted basis in states where regulation doesn’t allow us to tailor coverage or charge the right price for clients who are exposed in a more outsized way to catastrophes. Remember, affluent people want to live in beautiful places in sight of nature that are often more exposed to catastrophes. Where state regulators won’t allow us to tailor coverage in line with exposure and price it adequately, we’ll use our E&S capabilities. But frankly, I wish there was more flexibility within certain states’ regulation so that we could serve this customer base on an admitted basis to give them what they need and want to buy, rather than be forced to E&S.

While other insurers compete on price, Chubb PRS offers an extensive array of services backed by a renowned reputation for quality. Frankly, the business is a historic wellhead of our company’s brand reputation and gives the Chubb name a halo. Teams of Chubb engineers provide advice and services to help clients be more resilient against the threats of climate change. Home evaluation services utilize innovative technology, such as water leak detection systems, to prevent losses. We are reaching new clients and new demographics through digital distribution efforts, such as embedding insurance with luxury e-commerce retailers to offer protection for jewelry, collections and other valuables – all through a digitally enabled purchase experience.

Premium Growth by Geography

Percentage change in P&C net premiums written, 2023 versus 2022

*Total P&C includes Global Re, Combined International, Japan and other international operations, which are excluded from the regions.

A trusted brand-name insurer of large domestic and multinational European corporations

Europe is Chubb’s second-largest commercial P&C market after North America and the company’s third-largest region overall, with annual gross premiums of $7.5 billion. With more than 60 offices in 27 countries – from the U.K. across the entire European continent to parts of the Middle East – we have a rich history in Europe. Our presence in the U.K., for instance, dates back more than 100 years.

We serve businesses in Europe of all types and sizes through a substantial network of retail offices, while our Global Markets E&S division operates in the London wholesale market and Lloyd’s. Chubb is a major and trusted brand-name insurer of large domestic and multinational European corporations. We write 75% of the FTSE 100 and all 40 companies in the CAC 40.

For consumers in Europe, Chubb is a leader in employer-paid group personal and travel accident insurance for employees, and we are the leading cell phone insurer for the customers of mobile network operators. In the U.K., we have a market-leading position in the high-net-worth personal lines segment as well. Europe had another excellent year in 2023 with net premium growth of 9.4%.

In Latin America, we have major operations in nine countries, with Mexico, Chile, Brazil and Ecuador being among our largest. We insure consumers through A&H, personal lines and life, and we are a major commercial P&C insurer for businesses, in sum producing $3.3 billion in gross premiums annually. Mexico is our largest country in the region, where we are a top-five commercial P&C and surety insurer. As one of the largest auto insurers in the nation, we have policies on about 2 million vehicles.

The combination of digital distribution and traditional direct marketing through a roster of distinguished partners is one of the primary drivers of growth for Chubb in the region. We are the preferred insurance partner for Nubank, the #1 digital bank in Latin America, and Banco de Chile and Citibanamex, the second-largest banks in those countries. Net premiums in the region grew nearly 15% last year.

A unique, integrated proposition in Asia

Asia and the United States are the two most dynamic regions in the world for future economic and insurance market growth. The two regions represent about 77% of our business but 69% of the world insurance market. Looking forward, they are expected to grow 40% faster than the rest of the world and are likely the regions with our greatest long-term growth potential.

During the summer of last year, I moved my office to Asia for six weeks to spend more time meeting more people and to gain broader and deeper insight into trends and what’s driving the region. In total, I spent about nine weeks there over the year. While I have traveled in the region about two to four times a year for 40 years, trips of just one to two weeks simply limited my bandwidth to explore.

There is a lot more happening in Asia than just China and, though very important, what’s occurring between China and the rest of the region. What’s going on within and between ASEAN and North and South Asia is incredibly dynamic – it’s an example of growing regionalism. There is immense trade in goods, capital flows, innovation and travel by people between and among countries across the region. India, Japan and Korea are powerhouses – investing, building and spreading their influence throughout Asia, particularly ASEAN. It’s about the tech development that’s taking place, and the next generation of leaders and entrepreneurs who are emerging. And we’re well positioned to capitalize.

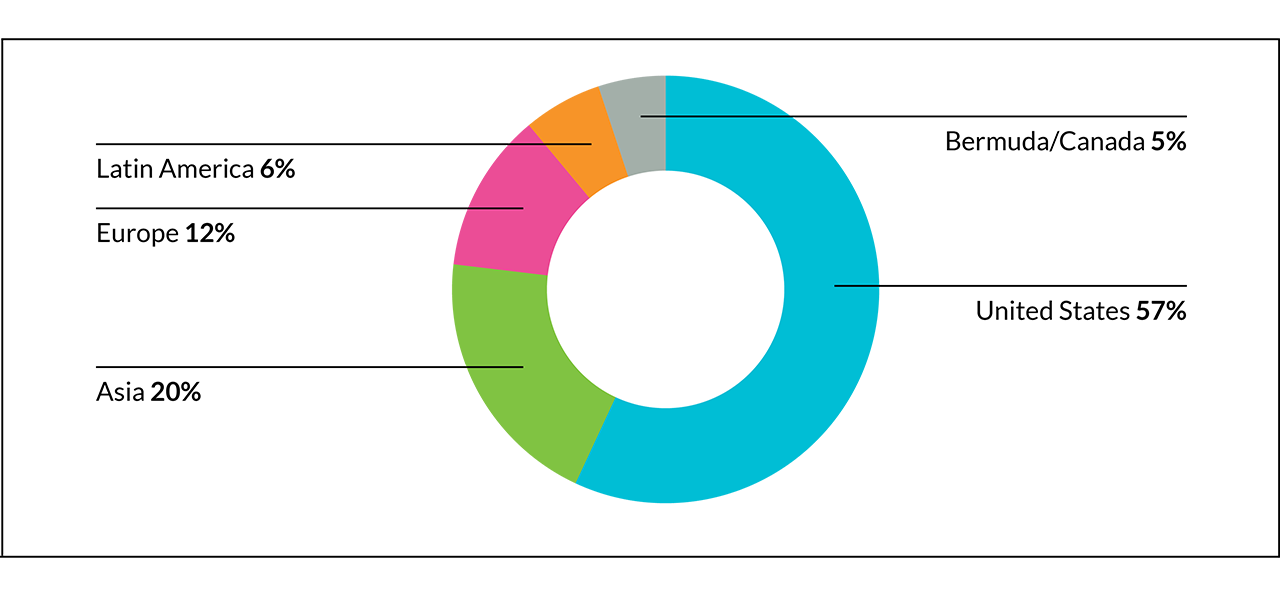

Geographic Sources of Premium

2023 net premiums written and deposits

With $10.7 billion in gross premiums and deposits, and operations in 15 countries in which we have built a deep local presence over many years, our Asia region is now 20% of our company. More than 75% of the business is consumer-focused – A&H, personal lines and life – and about 25% is commercial P&C. In 2023, Japan aside, Asia generated P&C net premium growth of 25%, with strong contributions from both consumer and commercial lines, while life premiums in the region grew more than 80%.

There is no better place to showcase our international consumer business than Asia – a collection of individual markets large and small with more than 2 billion people. We have the ability to bundle and cross-sell coverage across our consumer P&C and life product lines. Our direct marketing operation has more than 7,000 telemarketers, massive consumer databases, and powerful digital technology in the hands of a team with considerable marketing and sales know-how. We have distribution partnerships with some of the most successful digital companies in the world, giving us access to hundreds of millions of customers. To that point, we expect consumer premium revenue through our 100% digital channels to exceed $1 billion in 2024, more than 40% of which will originate in Asia.

Our commercial business in Asia is equally robust and benefited last year from continued favorable underwriting conditions in several major markets, including Hong Kong, Singapore and Australia, which alone produced about $1.2 billion in gross premiums. The dynamism I mentioned means a growing small and medium-sized (SME) and large business community across the region with growing needs for insurance. To reach and serve that base, you must be local in many markets – and we are there. Let me bring it to life with a few examples.

Korea is Chubb’s second-largest country after the U.S. with $3 billion in gross premiums. Our Korean leadership team is a powerhouse with an operation that combines life and non-life capabilities to predominantly focus on the consumer through direct response marketing and a network of thousands of agents and brokers. LINA, which stands for Life Insurance Company of North America, is our life company in Korea and is a well-regarded brand that dates back nearly four decades.

In Thailand, where we have both non-life and life companies, we have bancassurance partnerships with major Thai financial institutions such as Krungthai Bank, or KTB, one of the largest banks in that country with 40 million customers. We are transitioning sales through branches and traditional telemarketing to digitally embedded products. We bring Chubb’s considerable commercial P&C capacity and service solutions to Thailand’s large, middle and small business marketplace through a network of 16 branches, and we write 37 of the Stock Exchange of Thailand’s (SET) top 50 companies, including nine of the top 10.

In the dynamic and fast-growing consumer market of Vietnam, where we have life and non-life companies, our agency and brokerage distribution is complemented by partnerships with payments, banking, e-commerce, ride-share and travel platforms that give millions of emerging middle-class consumers access to Chubb’s products through digital channels.

Huatai in China: a rare, long-term opportunity

In China, we now own Huatai Group, which has three major subsidiaries – a property and casualty company, a life company, and an asset management company with more than $120 billion of funds under management. Chubb is the only foreign financial institution to majority own a Chinese financial services holding company. It took us 20 years to get government permission, and we have invested about $4 billion over the years to acquire the shares. Based upon any classic financial return model we overpaid. However, in this case, we purchased an opportunity – a long-term one. The licenses, provincial presence and branches throughout the country provide a rare opportunity to build something meaningful in the second-largest economy in the world, and one that is not going away. That’s the bet.

Today, Huatai has 600 branch offices and thousands of employees spread among nearly all the provinces. We insure average citizens for life, health and auto insurance, and from small private businesses to large state-owned enterprises for all kinds of commercial insurance. Our asset management company is one of the largest in the country, offering both retail and institutional mutual funds and boasting top-quartile fixed-income performance.

We compete in China with our model of doing business, and we are an example of a market-oriented meritocracy. Our innovation, skill in risk-taking and distribution, building and managing insurance companies, and dynamic nature are our advantages. The valuable savings and protection we provide for Chinese citizens is an example in China of a private sector solution versus relying on the state for protection.

Our business in China, Hong Kong and the Greater Bay Area – a $2 trillion GDP market – is relatively small for us today but has the potential to be sizable. Given the size of the Chinese economy and the vastness of the business community, the country’s aging population, the growing middle class, and the limited government safety net, the long-term opportunity is attractive. While there is much risk and no guarantee of success, ultimately, I have confidence in the culture and in the hardworking nature and capitalist spirit of the Chinese people. We are patient.

Chubb Life: predominantly A&H and risk products in life clothing

Our Life Insurance division includes an Asia-based international life insurance company, Chubb Life, which produces about 85% of the division’s life premium and deposits of $7.3 billion, and a growing worksite benefits business in North America under the Combined Insurance brand. Chubb Life operates in nine countries in North and Southeast Asia with a focus on protection and A&H-type health insurance products supplemented with savings-oriented plans. This product mix is the right kind of life business for us – predominantly A&H and risk products in life clothing combined with savings products that have minimum-to-no guarantees. Last year, net premiums were up 74%.

Our life business is leaning heavily into three macro trends in the Asia region: 1) Consumers have relatively little life and health insurance protection; 2) Wealth is being created at an unprecedented level. In Korea and Greater China, customers are aging, and it’s about legacy planning and quality of life in retirement. In Southeast Asia, customers are much younger, and it’s about protecting family and lifestyle, affording quality education, and access to international health care; and 3) Consumers are tech-savvy. Beyond coverage, they want access to digitally curated health services and personalized well-being reminders and rewards.

On the other side of the world, we have worked quietly over the last few years to convert Combined Insurance in North America to a worksite benefits business that offers supplemental A&H and life voluntary benefits plans. A team of 3,500 independent agents focuses on small businesses, while Chubb Workplace Benefits caters to mid- and large-size employers through brokers and consultants. This unit’s growth, both revenue and earnings, should emerge in a more meaningful way over the next year or two, and I will talk more about it then.

Reimagining how an insurance company should operate in a digital age

Over the last three to four years, we have been investing in our company’s digital transformation and our digitally native business unit – two separate efforts that are coordinated and will converge over time. We are making steady progress in our plan to transform our traditional flow businesses, which represent 70% of our company, into digital enterprises over the next few years, with the balance of our business becoming digitally enabled. These businesses are reorganized around multidisciplinary teams, bringing together underwriters or claims professionals with engineers, data analysts and managers who share common objectives and tasks. It breaks down silos. Transformation means reimagining how an insurance company should operate in a digital age, including how we employ and use data – our own and external – to drive analytics, AI literacy, straight-through processing, the customer experience, and underwriting and marketing insights. It’s about cycle times of change – speed and insight. Importantly, we expect and measure outcomes.

Our de novo digital business unit is expanding quickly in terms of revenue, products and capabilities with leading digitally native platforms and financial institutions, particularly in Asia and Latin America. This business has 25 million digital policies in force now and access to more than 375 million customers. Last year, we produced about $760 million in gross premiums through digital platforms and next year expect to top $1.1 billion with more than $70 million in underwriting income.

The emergence of AI and the power of large language models

In the transformational potential of artificial intelligence, the emergence of large language models (LLMs) in 2023 may prove a seminal moment. In my judgment, AI is not an instant game-changer in our industry or most industries, but rather its impact will continue to unfold over time and will be immensely powerful. It is one of those technologies, like the steam engine, that emerge and usher in a historic period of change. The implications for both good and bad, which we as societies are coming to understand, are enormous. AI brings exciting promise for science and medicine, education and learning, services, engineering, manufacturing, agriculture, finance – you name it.

On the other hand, AI is a weapon that potentially threatens our notion of free will, which is at the core of democracy. We are already beginning to see what it means for military capabilities and cybercrime, and it’s frightening. How do we govern AI, and what do we regulate? Who should do so, and how do we equip them? Is it even possible?

For Chubb and insurance, the power of LLMs will be profound. Algorithmic AI has been in use at Chubb for about six years in areas such as underwriting, claims and marketing. Using “ChubbGPT,” a secure version of ChatGPT within our firewall, employees perform research, write code and summarize reports. AI presents an extraordinary opportunity for us to unlock and maximize our rich trove of data to accelerate innovation, expand capabilities and bolster competitive differentiation. By exploiting our data as a strategic asset across multiple lines of business, geographies and products, we are advancing our ability to materially outperform through improved risk selection, pricing, portfolio management and operational efficiency.

As we continue to invest in AI capability, we will progressively unlock more complex, unstructured data to provide deep insights for decision-makers across the company. We are optimistic about the business value these AI solutions will bring to Chubb, but we are realistic. We recognize that adoption will be iterative and take time to reap rewards, especially when considering not only the evolution of the technology itself but also the breadth of our business and geographies, the intrinsic complexity of insurance, as well as emerging regulations.

Responsibly insuring the transition to a net-zero economy

Protecting our insureds includes supporting their resilience against the threat of a changing climate. We also seek to help society make an orderly transition to a net-zero economy in a responsible way that does not sacrifice our energy security needs. We are taking tangible actions in three distinct areas.

Chubb Climate+, our climate-focused business division, brings together extensive technical capabilities in underwriting and risk engineering to support businesses engaged in developing or employing new technologies and processes to reduce dependence on carbon. Climate tech insurance solutions address carbon capture, hydrogen, EV charging stations and industrial battery storage systems that allow clean energy producers, such as wind and solar, to store energy for efficient distribution.

For instance, in the U.K., Chubb Climate+ Renewables supports the growth of alternative and renewable energy projects, principally onshore wind and ground-mounted photovoltaic solar. In addition, Chubb has a leadership role in a new Lloyd’s of London consortium that provides insurance coverage for risks associated with the transit and storage of lithium batteries in the marine cargo market.

Through our underwriting actions, we support and encourage businesses to adopt best practices to help them achieve their sustainability goals. Our climate- and sustainability-based underwriting criteria for oil and gas extraction projects require clients to limit their emissions, or we won’t underwrite the risk. We are particularly focused on the capture or reduction of methane, a byproduct of oil and gas production that can be managed through controls and technologies. The digital Chubb Methane Resource Hub offers clients information and insights for measuring and mitigating methane emissions. We also limit the underwriting of oil and gas extraction in globally recognized conservation areas.

Through our risk engineering services, we help individuals, businesses and communities be more resilient to the effects of climate change. This includes conducting property resiliency assessments to help companies forecast their climate risks. Our political risk insurance division has helped finance remarkable conservation projects in places like Ecuador and Belize that support sustainable economic development and community resilience while providing debt relief.

One last thought on climate and digital: The convergence of two powerful trends – the world’s transition to cleaner energy and the inexorable digitization of everything – is driving a massive societal need for infrastructure investment. Think energy generation and transmission, data storage and resiliency-related construction to protect against the effects of climate change. The need is enormous – in the trillions of dollars – and governments don’t have the money. For the private sector, this mega-trend represents a growing asset class for investors, which, in turn, is creating the need for insurance to cover both the construction and operating-related risks of infrastructure. Investing in and protecting those investments is a large opportunity for those insurers with a global presence, large balance sheet and expertise. Chubb is ideally positioned.

Premium Distribution by Product

2023 net premiums written and deposits

America’s financial solvency: an existential risk

For perspective, looking back, government policies following the economic recession in 2008 supported an extended period of expansive monetary and fiscal stimulus. Persistent and enormous federal deficits caused the U.S. ratio of debt to GDP to nearly double. Meanwhile, negative “real” interest rates distorted asset prices and encouraged excessive risk-taking and use of leverage, inflating consumer and corporate balance sheets. Then, the government’s response to COVID exacerbated these conditions by injecting massive fiscal stimulus of almost $6 trillion into the economy. As a result, the broad money supply rose to nearly 120% of real GDP versus its long-term average of approximately 80%, leading to a predictable surge in inflation, deeply aggravated by mostly short-term supply chain problems.

To counter this inflationary spiral, the Federal Reserve has raised short-term rates and reduced its balance sheet by nearly $1.5 trillion. However, liquidity remains abundant, and the Fed’s security holdings remain at $7 trillion, or nearly twice the size of pre-COVID levels. Our economy is strong and resilient across a wide range of measures: Unemployment is low, and the outlook for ’24 is favorable.

The medium-term outlook for inflation remains uncertain. The wealth effect linked to liquidity and financial market valuations supports the uncertainty. While inflation in the goods sector has slowed, helping to reduce overall inflation, tight labor markets and a robust service sector continue to support elevated wage and price gains. The declining support for globalization, a reordering of supply chains, the transition to renewable energy, aging demographics, latent excess liquidity and expansive fiscal policies all pose challenges to inflation.

One of the greatest risks, in fact, an existential risk to the health of America, is lying in plain sight: our financial solvency. Despite solid economic fundamentals and near-record full employment, the U.S. ran a 2023 fiscal deficit of $1.7 trillion, or 6.3% of GDP. Total U.S. debt is now more than $34 trillion, or approximately 123% of GDP, and interest expense stands at 16% of revenue, similar to the capital structure of a BBB corporation. In fact, federal net interest costs are forecasted to exceed defense payments in 2024 for the first time in six decades.

In addition, entitlement spending is crowding out important funding for key discretionary sectors such as defense and infrastructure, and the Congressional Budget Office now projects all federal revenue will be consumed by entitlement payments and interest on the debt by 2030. With 50% of U.S. debt maturing within three years, declining Federal Reserve Treasury holdings, slack foreign demand and the intransigent nature of our divided political environment, the U.S. credit rating risks further downgrades. The prospect of a “crowding out” in financial markets, higher U.S. yields, inflation and a weakened U.S. dollar are real and growing risks without decisive action on the part of our government.

America’s central role in preserving security around the globe

The current geopolitical environment is defined by power distributed to more countries operating contrary to America’s interests. Russia, Iran and China each are seeking to revise the regional order in their respective regions and globally. At the same time, Iran is at the nuclear threshold, and North Korea is expanding its nuclear inventory. These developments are generating increased tail risks.

European countries lack capacity to tip the military balance in Ukraine’s favor. They are unable to defend themselves against Russian aggression without American security support. American-led efforts to support Ukraine’s defense have produced outsized returns on investment. Failure to sustain support for Ukraine’s defense would undermine the credibility of American resolve to stand down Russian aggression and raise the risk of emboldening Russia to expand its ambitions in ways that implicate NATO security commitments and threaten Europe. It would undermine America’s credibility with allies around the world and embolden our adversaries.

In the Middle East, Israel feels existentially vulnerable, and the Palestinians need a homeland and a future. Even though, on balance, none of the major actors sees benefit from an escalation of tensions, the regional dynamic is fragile. There is no path out of the current morass without active American leadership.

China, meanwhile, is demonstrating diminished patience with the status quo. Beijing is generating greater military friction in pursuit of its territorial claims in the Taiwan Strait, the South China Sea and along the border with India. China is investing in its “no-limits” partnership with Russia. America’s active alliance-building and military deterrence are essential to preserving regional peace and stability.

The United States and China are the two most powerful countries and account for more than one-third of global GDP. Even so, each’s ability to influence outcomes outside its borders is less than was the case during America’s unipolar moment from the end of the Cold War through the early part of this century.

China is viewed both as important and as a source of anxiety for many countries around the world. China is a revisionist and revanchist power that is pursuing a large-scale expansion in military capabilities. Its foreign policy is driven both by its historical aggrievement and an ambition to reshape the international system to suit its benefit. Beijing is protectionist and predatory in its economic practices. China is the largest trading partner for most countries in Asia and around the world. No country can do without China as a source of economic growth.

America plays a central role in preserving security in Europe, the Middle East and Asia. The U.S. is viewed as both indispensable but also unreliable. Our economy is the strongest in the world, our ability to innovate is unmatched, and our military remains the most powerful and capable in the world. At the same time, our political system produces unpredictable outcomes.

In the face of China’s assertiveness and America’s unreliability, countries around the world are hedging. Countries are avoiding aligning with either America or China across all domains.

There is a declining consensus inside our country for playing a leadership role. Our leaders are not making a strong case for our involvement abroad as a requirement for security and prosperity at home. The current direction of travel is toward increased nationalism and economic protectionism. This is not a direction that inspires confidence abroad or supports prosperity and innovation at home. It contributes to global instability and increases our vulnerability.

Restoring America’s traditional leadership role in global trade

Our economy is the envy of the world. Our country is a beacon: We are the land of opportunity, and we protect the sanctity of the individual. Our democratic values inspire. Our economy is market-oriented and supports a thriving private sector. We have a transparent legal system and strong institutions to administer justice. U.S. companies lead the world in technological innovation. Our country is a magnet for capital, technology, and the best and brightest from around the world.

None of this is guaranteed, and we confront fundamental challenges that threaten our future prosperity. At the global level, our leaders project disunity in putting forth a foreign policy and national security strategy that integrates economic and military capability with the promotion of American values.

At the national level, our leaders are deeply divided and tribal in their politics. They are more focused on political survival and partisan advantage than addressing our deep societal challenges. This inability to address obvious problems is a source of frustration for most Americans. For example, our leaders have proven shamefully inept at protecting the country’s borders and reforming immigration policies. Our country’s mounting national deficit is an existential problem right in front of our faces.

Burdensome regulation and outsized bureaucracy inhibit our progress in important areas. It takes too long and costs too much to build infrastructure in our country. Energy and transportation infrastructure are pillars of a modern economy and enablers of innovation. Chronic delays and exorbitant costs impact our growth.

Our country lacks a critical ability to produce ships, planes, missiles and munitions at the speed and scale needed to meet our own national security requirements and those of our security partners. It is undermining America’s value proposition for countries to align more closely with us. Rebuilding our defense industrial base in concert with our allies is an urgent priority.

While a view currently out of fashion, as part of our economic well-being and our national security and foreign policy, we should restore our traditional leadership role in global trade. After all, 95% of the world’s consumers live outside our borders.

Our country is strongest when other countries are invested in our security and economic growth agenda, and we in theirs. We are not giving adequate consideration to our allies’ requirements. Free trade agreements that include market access provisions are necessary to promote our vision of trade and unlock opportunities for our companies and workers. Deeper economic integration binds our fortunes more closely with those of our partners.

The prevailing narrative inside the United States today is that free trade destroys American jobs. I reject that narrative. America’s unrivaled global power in the post-World War II era was underwritten by our vision of market-oriented, rules-based fair trade. Reinvigorating America’s international trade leadership would strengthen America’s presence and staying power globally. It would support economic growth at home. And it would undercut Beijing’s preferred – and increasingly tarnished – narrative that countries must stand with China to prosper in the 21st century. A fair market-oriented trade system means we don’t allow countries to game the trading system. The notion of reciprocity in trade and market access, and the rules we each adopt, are fundamental.

Supply chains are no longer linear transmission mechanisms from suppliers of raw materials to producers to consumers. Supply chains now encompass a global web of companies and countries at a density, scope and complexity never seen in human history. It would be unwise and infeasible to attempt to unwind global supply chains.

However, we should diversify supply chains for critical resources to ensure supply. Although likely inflationary, diversification represents sound risk management against a range of potential shocks. These efforts need to be undertaken with thoughtfulness and precision, and not blunt-force moves guided by nationalism and protectionism.

No country is in a stronger position in the world today than America. Many of our greatest challenges are within our own scope to address. With wise, focused and determined leadership, our country can compete with any country in the world.

The U.S. and China: coexistence remains an inescapable requirement

In recent years, the U.S.-China relationship has grown increasingly rivalrous. Both countries see the other as a growing threat. Each has become more protectionist, more tolerant of friction, and more focused on military power in dealing with the other. Both countries are directionally moving to become more independent of the other.

China is continuing to grow more authoritarian at home and aggressive abroad. The Chinese leadership is unrelenting at home in their approach to imposing centralized control. China’s foreign policy has become more assertive, intolerant of criticism and forceful in responding to challenges to its interests. China’s leaders hold a different view of their behavior, believing they are responding to U.S.-led Western pressure to stifle China’s rise. Nevertheless, we view China as increasingly presenting a threat to our interests and values, as well as those of our allies and partners.

Given these trends, it’s all the more important to recognize that coexistence remains an inescapable requirement for both the United States and China. Neither country can subdue the other or force the other to abandon its ambitions. Acknowledging the mutual need for coexistence is a wise recognition of reality lest we have war. Coexistence requires active engagement to establish the terms by which both sides relate to each other. Engagement is not a form of surrender, and it does not mean either side needs to admire the other. Engagement is how relationships are built and knowledge is shared. It is how leaders in both countries acquire an understanding of each other and how trust is developed at a personal level. These relationships are a key ingredient for leaders to be able to craft a better framework for the relationship going forward.

Our country will best manage its competition with China if we show firmness in protecting our interests and supporting our alliances while showing patience and confidence in our long-term competitive advantages. In my judgment, China is making domestic and foreign policy decisions that are undermining its national competitiveness and interests. It would be wise for Washington, while defending our interests, to leave China room either to double down on its mistakes or adjust.

Chubb: our launching pad into the future

I want to thank my fellow employees and our senior management team for their outstanding contributions last year. You never cease to amaze me. Your technical proficiency, drive and creativity are matched only by your dedication to our clients and business partners. You are the brand. I also want to thank our thoughtful, active and supportive Board of Directors. I appreciate your wise counsel and commitment to our mission.

Our best days are in front of us. The company we have built is our launching pad into the future as we capitalize over time on an enormous number of opportunities we could only dream about a decade or two ago. Acknowledging that ours is a long-term business, we are patient in strategy. Exceeding our ambitious objectives, we are impatient in execution.

On behalf of the entire organization, thank you for your investment and trust in us.

Sincerely,

Evan G. Greenberg

Chairman and Chief Executive Officer

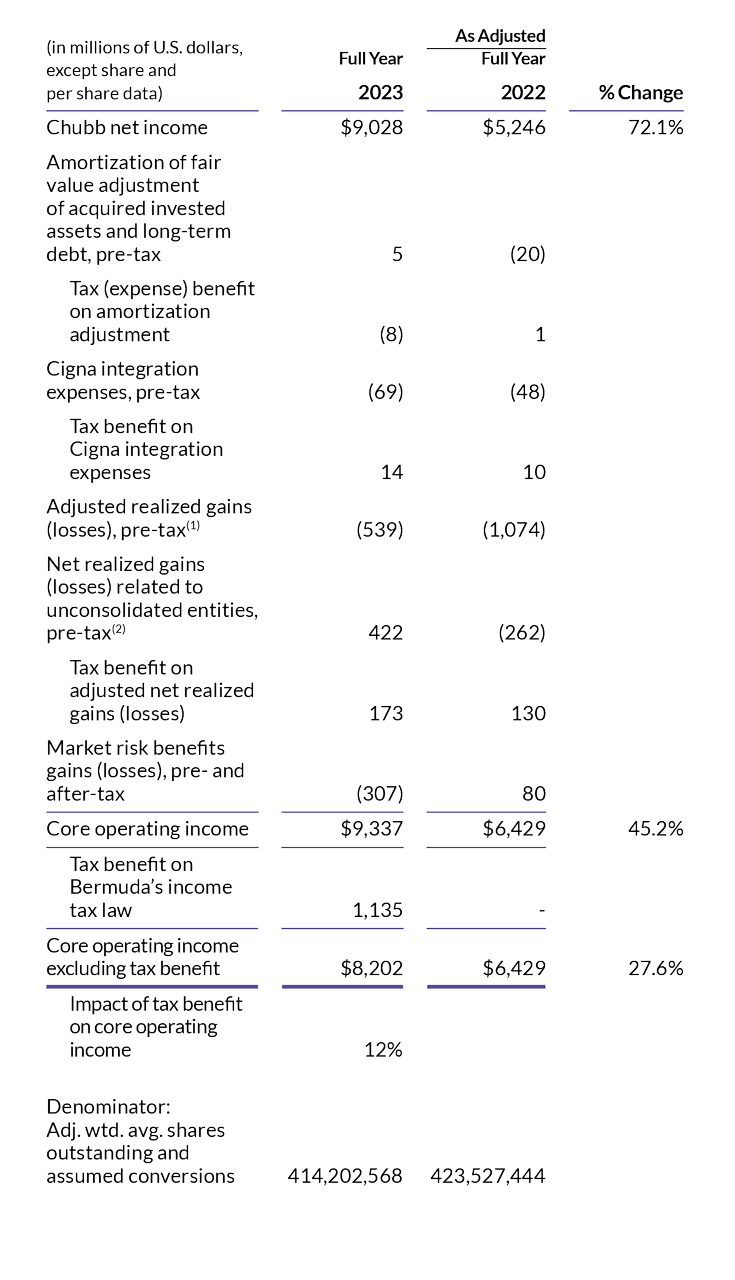

Non-GAAP Financial Measures

This document contains non-GAAP financial measures. The below non-GAAP financial measures, which may be defined differently by other companies, are important for an understanding of our overall results of operations and financial condition. However, these measures should not be viewed as a substitute for measures determined in accordance with generally accepted accounting principles (GAAP).

We provide certain financial measures on a constant-dollar basis (i.e., excluding the impact of foreign exchange). We believe it is useful to evaluate the trends in our results exclusive of the effect of fluctuations in exchange rates between the U.S. dollar and the currencies in which our international business is transacted, as these exchange rates could fluctuate significantly between periods and distort the analysis of trends. The impact is determined by assuming constant foreign exchange rates between periods by translating prior period results using the same local currency exchange rates as the comparable current period.

Certain metrics in this document are presented excluding the one-time deferred tax benefit of $1.14 billion for transition provisions included as part of Bermuda’s newly enacted income tax law. We believe that excluding the impact of the one-time deferred tax benefit provides a better evaluation of our operating performance and enhances the understanding of the trends in the underlying business that may be obscured by this one-time item.

As Adjusted results in this document are results for prior periods presented in accordance with the Long-Duration Targeted Improvements (LDTI) U.S. GAAP guidance.

Core operating income, net of tax, relates only to Chubb income, which excludes noncontrolling interests. It excludes from Chubb net income the after-tax impact of adjusted net realized gains (losses), market risk benefit gains (losses), Cigna integration expenses, the amortization of fair value adjustment of acquired invested assets and long-term debt related to certain acquisitions. We believe this presentation enhances the understanding of our results of operations by highlighting the underlying profitability of our insurance business. We exclude adjusted net realized gains (losses) because the amount of these gains (losses) are heavily influenced by, and fluctuate in part according to, the availability of market opportunities. We exclude the amortization of fair value adjustments on purchased invested assets and long-term debt related to certain acquisitions due to the size and complexity of these acquisitions. We also exclude Cigna integration expenses, which are incurred by the overall company and are included in Corporate. These expenses include legal and professional fees and all other costs directly related to the integration activities of the Cigna acquisition. The costs are not related to the on-going activities of the individual segments and are therefore also excluded from our definition of segment income. We believe these integration expenses are not indicative of our underlying profitability, and excluding these integration expenses facilitates the comparison of our financial results to our historical operating results. References to core operating income measures mean net of tax, whether or not noted.

The following table presents the reconciliation of Chubb net income to Core operating income and Chubb net income per share to Core operating income per share:

Table continued

Core operating return on equity (ROE) and Core operating return on tangible equity (ROTE) are annualized non-GAAP financial measures. The numerator includes core operating income (loss), net of tax. The denominator includes the average Chubb shareholders’ equity for the period adjusted to exclude unrealized gains (losses) on investments, current discount rate on future policy benefits (FPB), and instrument-specific credit risk – market risk benefits (MRB), all net of tax and attributable to Chubb. For the ROTE calculation, the denominator is also adjusted to exclude Chubb goodwill and other intangible assets, net of tax. These measures enhance the understanding of the return on shareholders’ equity by highlighting the underlying profitability relative to shareholders’ equity and tangible equity excluding the effect of these items as these are heavily influenced by changes in market conditions. We believe ROTE is meaningful because it measures the performance of our operations without the impact of goodwill and other intangible assets.

Core operating return on equity (ROE) and Core operating return on tangible equity (ROTE)

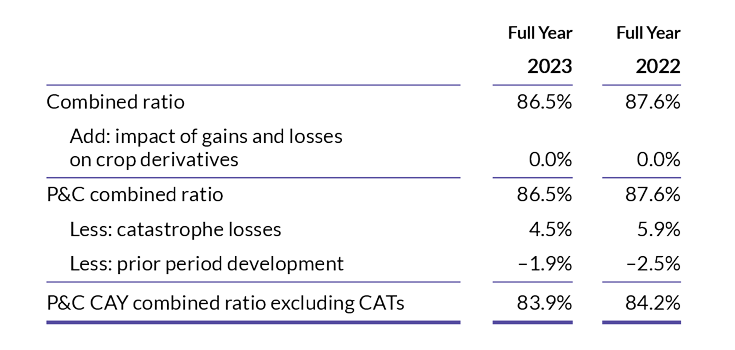

Combined ratio measures the underwriting profitability of our property and casualty business. P&C combined ratio and P&C Current Accident Year (CAY) combined ratio excluding Catastrophe losses (CATs) are non-GAAP financial measures.

The following table presents the reconciliation of combined ratio to P&C combined ratio, and the reconciliation of P&C combined ratio to P&C CAY combined ratio ex CATs:

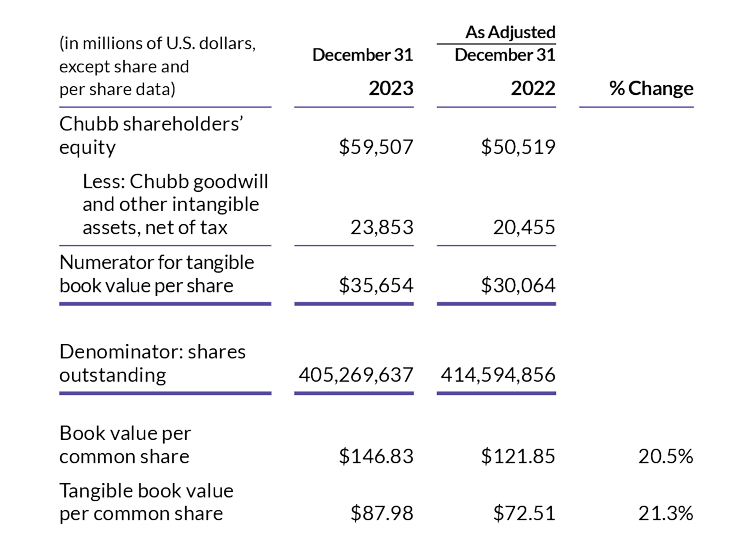

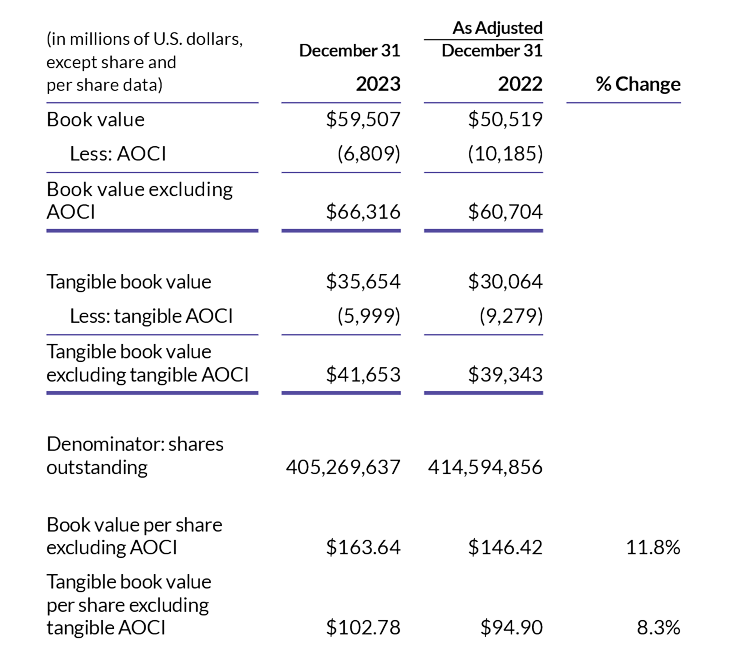

Book value per common share is Chubb shareholders’ equity divided by the shares outstanding. Tangible book value per common share is Chubb shareholders’ equity less Chubb goodwill and other intangible assets, net of tax, divided by the shares outstanding. We believe that goodwill and other intangible assets are not indicative of our underlying insurance results or trends and make book value comparisons to less acquisitive peer companies less meaningful.

The following table presents a reconciliation of book value per common share to tangible book value per common share:

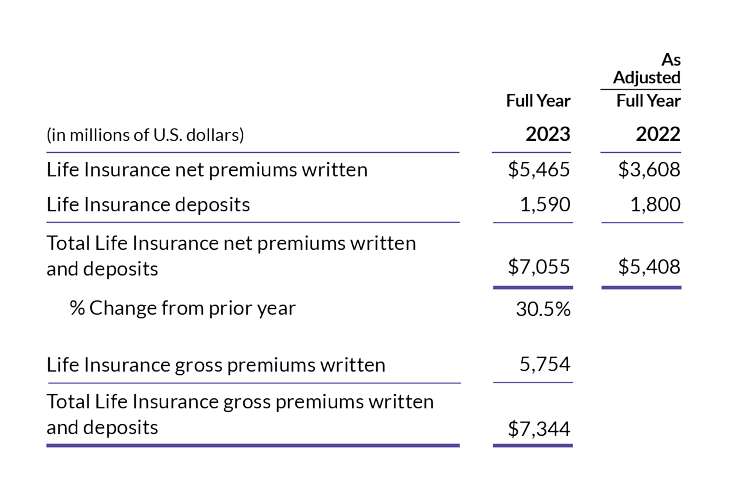

Life Insurance net premiums written and deposits is a non-GAAP financial measure which includes Life Insurance net premiums written and deposits collected on universal life and investment contracts. Deposits collected on universal life and investment contracts (life deposits) are not reflected as revenues in our consolidated statements of operations in accordance with GAAP. However, new life deposits are an important component of production and key to our efforts to grow our business.

The following table presents a reconciliation of Life Insurance net premiums written and deposits

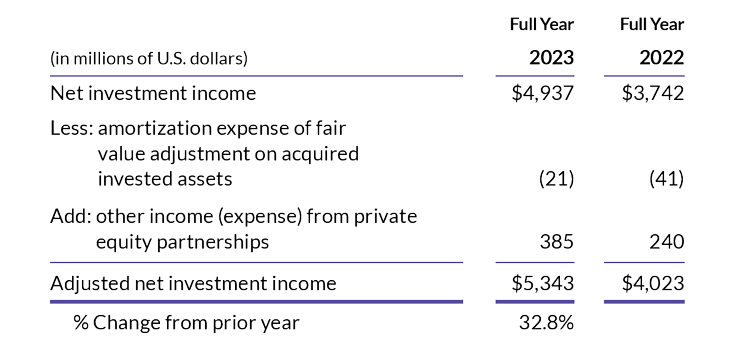

Adjusted net investment income is net investment income excluding the amortization of the fair value adjustment on acquired invested assets from certain acquisitions, and including investment income from partially-owned investment companies (private equity partnerships) where our ownership interest is in excess of 3% that are accounted for under the equity method. We believe this measure is meaningful as it highlights the underlying performance of our invested assets and portfolio management in support of our lines of business.

The following table presents a reconciliation of net investment income to adjusted net investment income:

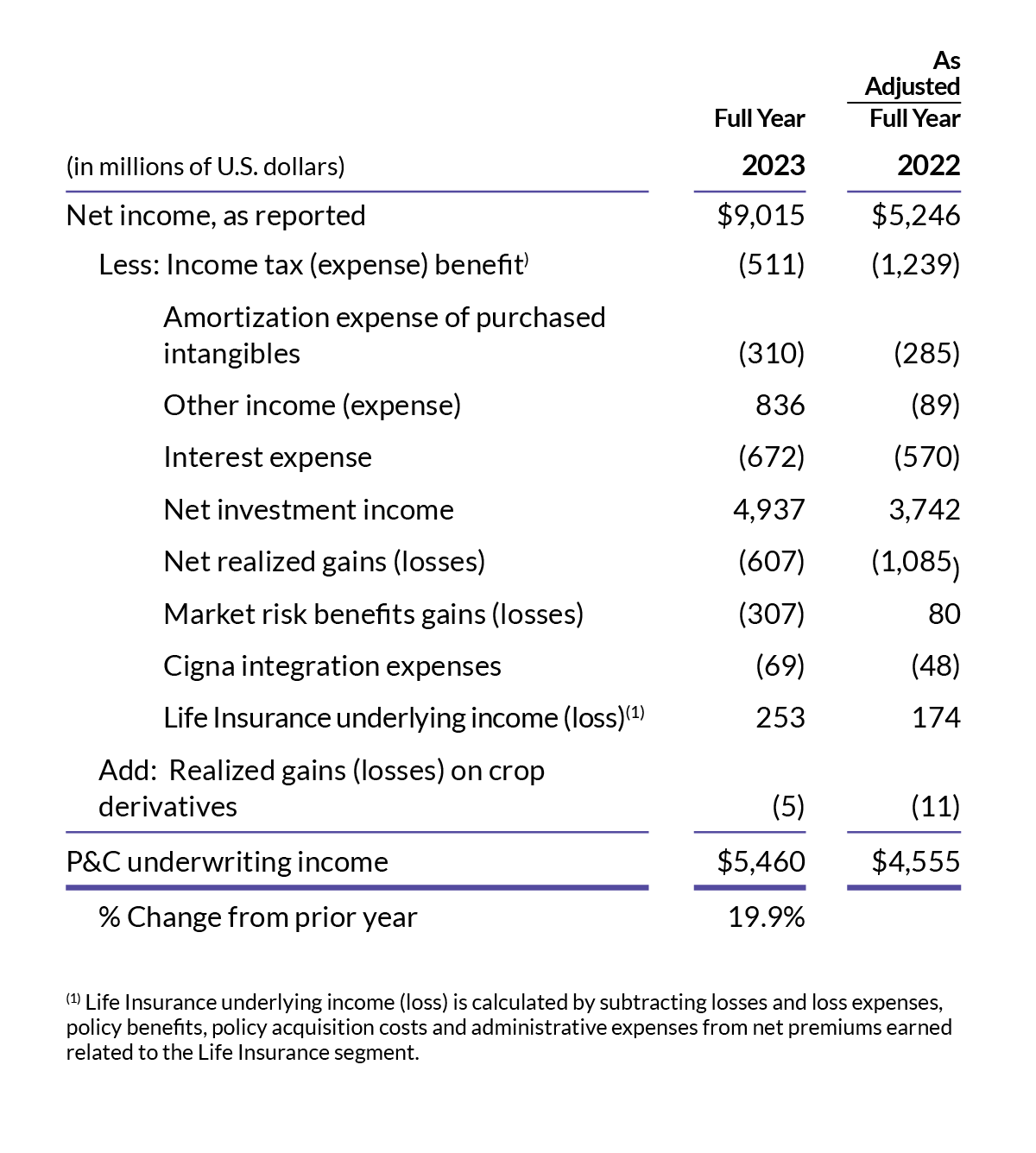

P&C underwriting income is underwriting income excluding the Life Insurance segment. We use P&C underwriting income (loss) and operating ratios to monitor the pre-tax results of our P&C operations without the impact of certain factors, including net investment income, other income (expense), interest expense, amortization expense of purchased intangibles, Cigna integration expense, amortization of fair value of acquired invested assets and debt, income tax expense, adjusted net realized gains (losses), and market risk benefits gains (losses).

The following table presents a reconciliation of net income to P&C underwriting income:

Book value per common share and tangible book value per common share excluding accumulated other comprehensive income (loss) (AOCI), excludes AOCI from the numerator because it eliminates the effect of items that can fluctuate significantly from period to period, primarily based on changes in interest rates and foreign currency movement, to highlight underlying growth in book and tangible book value.

The following table provides a reconciliation of growth in book value per common share and tangible book value per common share excluding AOCI:

Cautionary Statement Regarding Forward-Looking Statements

Forward-looking statements made in this letter, such as those related to company performance, growth opportunities, economic and market conditions, product and service offerings, commitments, and our expectations and intentions and other statements that are not historical facts, reflect our current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that could cause actual results to differ materially, including without limitation, the following: competition, pricing and policy term trends, the levels of new and renewal business achieved, the frequency and severity of unpredictable catastrophic events, actual loss experience, uncertainties in the reserving or settlement process, integration activities and performance of acquired companies, loss of key employees or disruptions to our operations, new theories of liability, judicial, legislative, regulatory and other governmental developments, litigation tactics and developments, investigation developments and actual settlement terms, the amount and timing of reinsurance recoverable, credit developments among reinsurers, rating agency action, infection rates and severity of pandemics and their effects on our business operations and claims activity, possible terrorism or the outbreak and effects of war, economic, political, regulatory, insurance and reinsurance business conditions, potential strategic opportunities including acquisitions and our ability to achieve and integrate them, as well as management’s response to these factors, and other factors identified in our filings with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Detail of artwork on cover

Donna Huanca

MAGMA SLIT #2 (FALL), 2021

oil, sand on digital print on canvas

90 9/16 x 129 15/16 inches

(230 x 330 cm)

© Donna Huanca

Courtesy: the artist and Sean Kelly, New York/Los Angeles