Environment & Climate Change

Corporate citizenship

- Recognizing and responding to the reality of climate change across our businesses

- Managing environmental risk for our customers with innovative products and risk engineering solutions

- Supporting resilience projects throughout the world

- Protecting biodiversity and conserving land

- Reducing the environmental footprint of our own operations

Chubb and climate change

Chubb is an underwriting company, and the company strives to emphasize quality of underwriting. The company’s underwriting strategy is to manage risk by employing consistent, disciplined pricing and risk selection. Chubb applies the same risk management rigor to its broadly diversified investment portfolio as it does to the company’s underwriting practice. In addition, Chubb accounts for the potential impact of catastrophe and climate risks on the company’s own facilities and operations. Direct risk to Chubb’s business operations exists to the extent that increasingly frequent or severe weather events associated with climate change occur where Chubb has offices.

At Chubb, assessing and managing risk starts at the top, with senior management. Risk management at Chubb is rigorous, with processes and governance to provide checks and balances. Chubb’s global enterprise risk management (ERM) framework — which encompasses climate risk — is embraced by colleagues at all levels of the company, from the Chief Executive Officer (CEO) and Board of Directors, down to each business unit and function. It is broadly multi–disciplinary and one of its objectives is effective governance.

The potential impacts of climate change on the insurance industry are myriad and multivariate. These risks and opportunities fall broadly into three categories: physical risks and opportunities; transition risks and opportunities; and liability risks and opportunities

Corporate Sustainability Policies

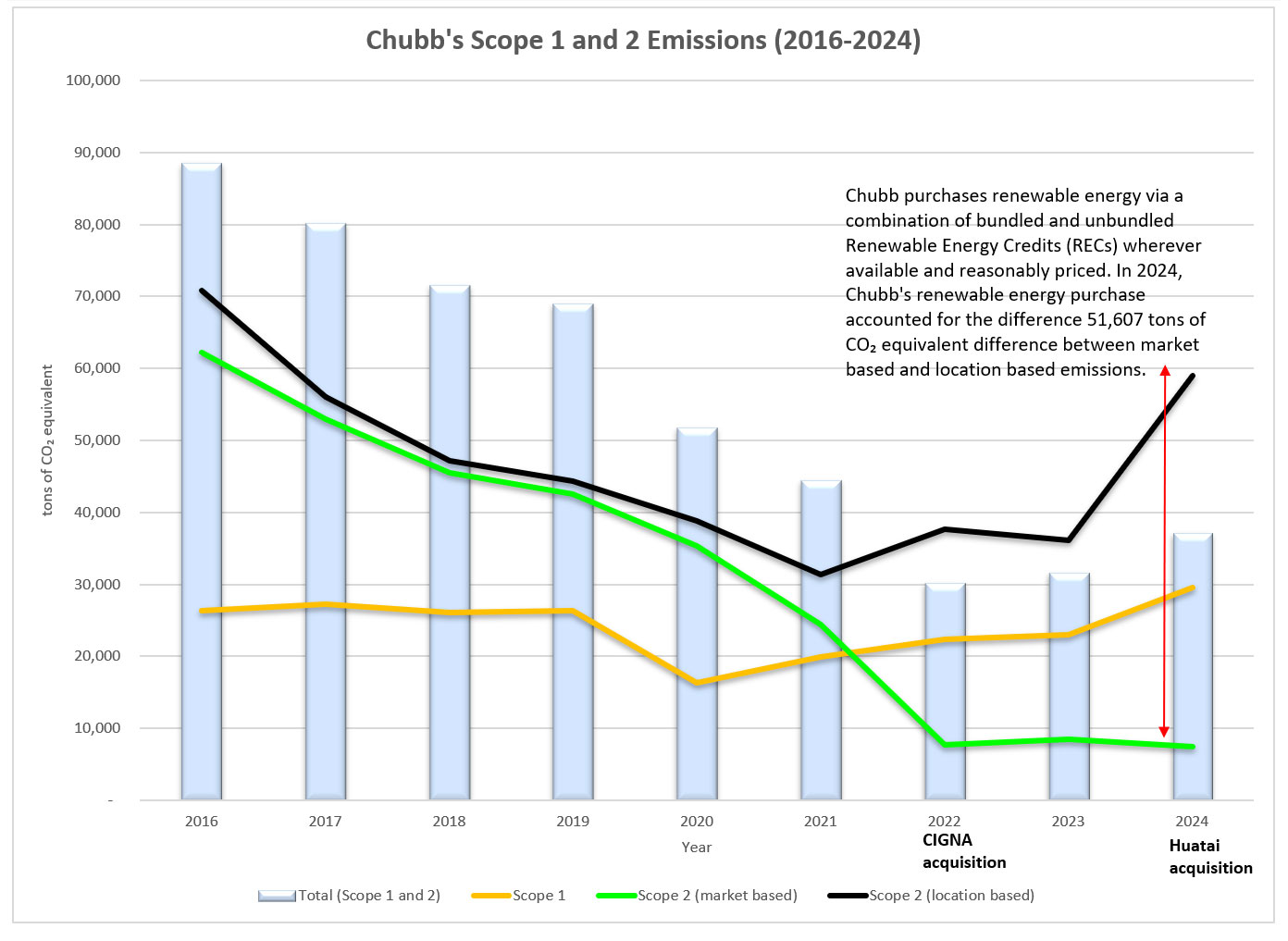

At Chubb, we seek to implement corporate sustainability policies that deliver enduring operational efficiencies and positive environmental outcomes across our businesses. As part of these efforts, we track and report our scope 1 and scope 2 greenhouse gas emissions on an annual basis in our Sustainability Report.

Chubb purchases renewable energy via a combination of bundled and unbundled Renewable Energy Credits (RECs) wherever available and reasonably priced. In 2024, Chubb's renewable energy purchase accounted for the difference 51,607 tons of CO₂ equivalent difference between market based and location-based emissions.

Chubb's Scope and Scope 2 market based emissions declined from 2016 through 2024. This was achieved primarily through Chubb's Green Power Purchase Policy, which states that Chubb will purchase renewable energy wherever available and reasonably priced. Chubb's renewable energy purchases include PPAs, bundled RECs, and unbundled RECs. They do not include hydro power or nuclear power.

Corporate Environmental Program goals

The Corporate Environmental Program has additional operational goals, including establishing a recycling program in each office and working toward 100% adoption, globally discontinuing use of disposable plastic water bottles, removing all disposable Styrofoam products, purchasing only sustainable copy paper, and reducing paper consumption year over year. A number of Chubb’s offices, including some of our largest locations, have met these goals. Others are making progress on the journey to achieve them.

Environmental philanthropy

The environment is a priority in Chubb’s corporate philanthropy. Chubb supports communities around the world in which we live and work through established philanthropic entities and company-sponsored volunteer initiatives.

Grants from Chubb’s charitable foundations have helped preserve sensitive lands and habitats across the world, finance “green” business entrepreneurs, and support educational programs that promote a healthy and sustainable environment.

In 2025, Chubb announced Blue Boundaries, an ambitious partnership between the Chubb Charitable Foundation and the National Geographic Society. Blue Boundaries is dedicated to advancing science, exploration, and conservation to protect some of the planet's most vital ecosystems. The program focuses on the health and preservation of ecosystems where and water converge — freshwater wetlands, coastal systems, and coral reefs, which are critical to the planet's health on local, regional, and global scales.