Chubb 2023 Climate–Related Financial Disclosure

About This Report

The Chubb Corporate Environmental Program is now in its 17th year. The company has long been committed to communicating important information about its environmental initiatives to our clients, shareholders, employees, business partners, the communities where we operate and others who have an interest in our company, our industry and the environment. This report is the third issued by Chubb since we began reporting using the Task Force on Climate-Related Financial Disclosures (TCFD) framework in 2021.

This report reflects Chubb’s views and actions with respect to climate risk management and climate strategy. We are committed to supporting our clients as they navigate a transition to a low-carbon economy, and we are actively supporting this transition across our company through the products and services we offer, our underwriting and investment decisions, our philanthropic support and our public engagement on critical climate issues. This report provides insight into where we are and where we are going.

Introduction

An Underwriting-Focused Approach to Addressing Climate Change

We are proud to present Chubb’s third annual TCFD Report, which reflects our ongoing work to manage our climate risks and opportunities and take an evidence-based approach to addressing climate change. We remain firmly committed to our responsibility to encourage the transition to a net-zero economy while recognizing the ongoing energy needs of the global economy. We will continue to be guided by the fundamental underwriting principles that underlie our business and the best available climate science as we seek to work with our clients and provide essential risk transfer capacity to support the net-zero transition.

We actively assess new climate disclosure recommendations as they arise to identify emerging trends. In the preparation of this year’s report, we have reviewed the IFRS Requirements for Disclosure of Climate-Related Information, the SASB standards for insurance, and the Net Zero Insurance Alliance’s Target Setting Protocol. While we have some substantive and process concerns about the proliferation of various climate disclosure regimes, we have endeavored to include relevant and applicable data responsive to these standards.

Addressing Scope 3 Emissions

Insurance companies do not produce substantial greenhouse gas (GHG) emissions, but many of our clients do. Those client emissions are what we refer to as Scope 3 emissions. Over the past year, a number of organizations have promulgated approaches to the calculation of Scope 3 emissions in the insurance industry. Many of these approaches rely on “insurance associated emissions,” which seek to attribute emissions of clients directly to an insurer, using premiums paid by the client as a base for attribution. As a general matter, we believe that appropriate focus should be on advancing the scientific knowledge, technological development and government action necessary to reduce GHG emissions across the economy. More specifically, focusing on the absolute or relative amount of premium revenue derived from insuring producers of significant GHG emissions is unlikely to provide any useful metric in advancing the low-carbon transition. Simply put, insurance premiums for any particular client and across industry sectors will change for many reasons, such as the ebb and flow of market cycles, without any relation to changes in emissions in the real economy, leading to the potential of significant fluctuations in “insurance associated emissions” that have nothing to do with actions by the insurer or insured to address GHG emissions. We do not see the value that such an approach has in providing transition-relevant information for the management of our climate risks or decision-relevant information to our investors. We believe that our holistic approach to GHG reduction will more effectively advance the transition and our approach focuses on three key areas:

- Chubb Climate+. In January 2023, we announced the launch of Chubb Climate+, a global, interdisciplinary team of underwriters and engineers focused on providing essential risk management services to support the transition. More details on Chubb Climate+ can be found in the Strategy section of this report.

- Oil and Gas Underwriting Criteria. In March 2023, we became the first global insurer to announce methane criteria for oil and gas extraction activities. By combining our criteria with risk engineering support we provide on-the-ground engagement and support for our clients as they work to address their greenhouse gas emissions. More details can be found in the Strategy section of this report.

- Supporting Thought Leadership on the Role of Insurance in the Net-Zero Transition. We are proud to continue our industry leadership in encouraging a science-based approach to climate changes, including our support of the University of Pennsylvania to facilitate dialogue between investors, regulators, insurance companies and other stakeholders regarding the role of the insurance industry in facilitating the transition to a net-zero economy.

We understand that our investors seek information to quantitatively assess both our exposure to climate risks and our progress in facilitating the transition to a net-zero economy. We believe that the most essential information we can provide relates to our efforts to grow our support of the transition activities of our clients through Chubb Climate+ and to assess our engagement efforts through our underwriting criteria. Further data on these efforts are provided in the Metrics and Targets section of this report.

A Note on Emerging Climate Disclosure Frameworks

Over the last year, a number of approaches to climate disclosure have been newly promulgated or elevated in prominence. Chubb actively evaluates new approaches to climate disclosures to assess their alignment with our broader business strategy. Our assessment of frameworks and methods turns on (1) alignment with our broader climate strategy, (2) assessment of potential financial materiality of information, and (3) assessment of whether the framework or methodology helps us to evaluate our role in facilitating the transition to the net-zero economy. We favor approaches that allow us to focus on financially material issues and facilitating the reduction of GHG emissions in the real economy over those that remain narrowly focused on counting or are overly reliant on estimation of data. Our views on key emerging climate disclosure frameworks and methodologies are as follows:

IFRS S-2 Standard for Climate-Related Financial Disclosures: Released in June 2023, the IFRS S-2 standard is one of two initial standards created by the International Sustainability Standards Board. We appreciate the work of the ISSB and its ongoing focus on providing material information to investors. We agree with the ISSB’s adoption of the TCFD framework as a useful tool to identify and report financially material information to investors. We are continuing to work to evaluate and understand ISSB’s specific proposed requirements for the calculation of financed emissions, and their applicability to our business and we agree with the S-2 standard’s decision to exclude disclosures of underwritten emissions at this time. In considering materiality metrics that may apply to climate and sustainability reporting, Chubb believes that financial materiality is the most appropriate.

SASB Insurance Sector Standard: The IFRS standards encourage adoption of the SASB sector-specific standards. We are currently in the process of evaluating the SASB standards and their materiality for our business.

SBTi: In 2022, the SBTi published the Financial Sector Science-Based Targets Guidance. In the 2022 Guidance, the SBTi encourages the setting of targets for aligning investment portfolios with climate stabilization pathways while at the same time acknowledging that it is not currently clear which actions by the financial sector lead to GHG emissions reductions in the real economy. As explained elsewhere in this report, Chubb chooses to focus its climate strategy on tangible actions that we believe will reduce emissions in the real economy, and we are actively exploring the best methods to execute on this approach consistent with our broader strategy. We are closely monitoring the SBTi’s development of the Financial Institutions for Net Zero (FINZ) standard. As of this date, we understand the development of the FINZ standard for insurance is in its early stages. However, we note that the currently available public consultation materials for the broader FINZ standard include a Fossil Fuel Finance Position Paper that expressly contemplates that the financial services industry will end its support for the fossil fuel industry. This requirement cannot be squared with the realities of current fossil fuel dependence across the global economy.

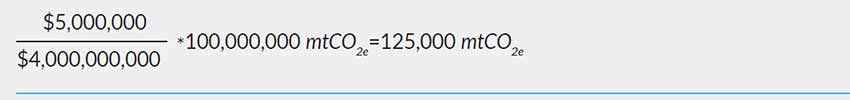

Partnership for Carbon Accounting Financials (PCAF) Insurance Associated Emissions Methodology: As explained in our 2022 TCFD report, Chubb participated in the public consultation process for the PCAF insurance associated emissions methodology. We expressed significant technical concerns that have not been addressed. Most importantly, the calculation of the PCAF attribution factor for insurance will vary for many reasons that have nothing to do with emissions in the real economy. For example:

Say that in year one an insurer sells a policy with a $5 million premium to an oil and gas company with $4 billion in revenue and a total reported GHG emissions inventory of 100 million metric tons. Under the PCAF methodology, the “insured emissions” associated with this client would be:

In year two, the client has the same $4 billion in revenue, but has reduced GHG emissions 20% to 80 million metric tons. However, due to increases in replacement and reinsurance costs, the same insurance policy now costs $7 million. In this case “insured emissions” would be:

The result is that “insured emissions” have gone up, while emissions in real economy have gone down. While this may be an extreme example, it demonstrates the potentially limited utility that the PCAF methodology has in assessing GHG emissions reductions in the real economy.

Governance

Chubb addresses climate risk through the oversight functions and active engagement of its Board of Directors, through extensive involvement of its most senior executives and through its global enterprise risk management (ERM) framework.

Board of Directors Climate Change Oversight

The Board of Directors recognizes the critical risks arising from climate change and is actively engaged in overseeing the company’s climate-related strategies, including the development of its climate policies and climate-related business activities. The Board and its committees receive regular updates on climate issues from management and external experts.

In addition to the full Board’s general oversight, two Board committees are charged with specific climate-related oversight responsibility:

- Nominating & Governance Committee: oversees our corporate citizenship activities and environmental, social and governance (ESG) policies and initiatives, including those relating to climate change and the environment, such as our fossil fuel-related underwriting and investment policies, corporate environmental goals and philanthropic efforts. The committee also receives updates and provides input on feedback from shareholders and other stakeholders on Chubb’s climate efforts.

- Risk & Finance Committee: oversees our ERM function, which includes extensive analysis of climate risk, including climate-related catastrophe risk, such as increased threats of wildfire, sea level rise and hurricane frequency and intensity, and reviews investment risks associated with climate change. For example, over the past year the committee received detailed presentations and engaged in discussions with management on various activities and initiatives relating to climate risk, such as governance, insurance products and services initiatives, investment strategies and ERM actions.

Management Responsibilities

Chubb is engaged in a wide range of climate-related activities that include:

- Identifying and analyzing climate risk;

- Public engagement on climate issues with government officials, climate advocacy groups, climate experts and a variety of other interest groups;

- Consideration and implementation of appropriate climate-related underwriting and investment actions;

- Limiting the company’s own GHG emissions; and

- Providing philanthropic support for climate resilience projects.

Chubb’s CEO and its Executive Committee provide oversight and direction of these activities and set the company’s climate-related strategies. The CEO engages extensively on climate issues, including in his annual shareholder letter and other public communications. Other senior executives with climate-related responsibilities include:

- The General Counsel coordinates the company’s ESG initiatives, including its climate-related policies and strategies.

- The Chief Risk Officer oversees the ERM function, including risks associated with climate change. Various management teams, including the Risk and Underwriting Committee, product boards and risk-related committees, meet regularly to evaluate specific risks and risk accumulation in Chubb’s business activities and investments.

- The Global Climate Officer is responsible for coordinating Chubb’s climate-related strategies and supporting the execution of business and public policy initiatives. The Global Climate Officer also oversees our internal climate activities, including greenhouse gas emissions measurement and reduction commitments.

Strategy

“As an insurer, our business is to provide protection to our insureds, which includes supporting their resilience against the threat of a changing climate. We have an objective to help society make an orderly transition to a net-zero economy in a responsible way that does not sacrifice our energy security needs. Through our underwriting actions, we can support and encourage businesses to adopt best practices to achieve these goals. We are serious about being a leader in sustainability and continue to demonstrate our commitment with realistic, tangible actions rather than make hollow net-zero pledges that are, in my judgment, little more than greenwashing.”

— Evan Greenberg, Chief Executive Officer

Chubb believes the most effective use of its resources to support society’s transition to net zero is to provide our clients with the risk transfer capacity necessary to facilitate their transition efforts. Our climate strategy is underwriting-focused and consists of three main pillars: (1) applying our underwriting and engineering expertise to support the technologies that will promote the transition to the net-zero economy, (2) promoting climate resilience through engineering and new service offerings, and (3) applying a science-based underwriting approach to develop technical underwriting criteria that encourage the adoption of controls and best practices in high-emitting industries.

Chubb Climate+: Underwriting for the Transition and Engineering for Climate Change Resilience

In January 2023, the company announced the launch of Chubb Climate+, our new global climate change practice. This practice focuses on facilitating and advancing a global transition to a net zero economy, by expanding the company’s already market-leading position in the clean tech industry. Chubb Climate+ will provide a range of global solutions to support the company’s clients in their transition to a net zero economy and increase their resilience to the physical impacts of climate change. The practice draws on Chubb’s extensive technical capabilities in underwriting and risk engineering, bringing together Chubb units engaged in traditional, alternative and renewable energy, climate tech, agribusiness and risk engineering services. Chubb Climate+ will provide a broad spectrum of insurance products and services to businesses engaged in developing or employing new technologies and processes that support the transition to a net zero economy. It will also provide risk management and resiliency services to help those managing the impact of climate change. Our commitment to this endeavor is reflected in the scope of our Chubb Climate+ business: as of January 2023, Chubb insured one-third of the Clean Tech 100. On the underwriting side, Chubb Climate+ is focused on growing our practice in renewable energy and Clean Tech. We have defined our Clean Tech occupancies as follows:

Chubb Climate+ Clean Tech Occupancies

- Renewable & Alternative Energy

Companies supporting solar, wind, hydro, geothermal, biomass, hydrogen, biofuels, gasification, nuclear - Built Environment & Energy Efficiency

Building automation, efficient heating and cooling equipment, alternative materials, industrial processes, green concrete/steel, adaptation, waste-water technology - Food & Agriculture

Vertical farming, ag tech, plant-based/cellular foods, crops engineering, low-carbon fertilizer, aquaculture - Transport & Mobility

Electric vehicles, EV component parts, charging stations and infrastructure, maritime decarbonization, aviation, micro-mobility, contractors’ equipment - Storage & Transmission

Batteries, alternative storage, fuel cells, smart grids, transmission infrastructure - Carbon Technology & Climate Finance

CCUS, nature-based solutions, carbon financial markets, accounting, reporting and ratings, venture capital, incubators and associations - Further information about the growth of Chubb Climate+ is set forth in the Metrics and Targets section below.

With respect to risk engineering services, we have grown the risk engineering team by adding three new experts on climate, resilience and adaptation. We launched our first climate-focused engineering service: Chubb Climate+ Resilience. Chubb Climate+ Resilience provides our clients with insights into their physical climate hazard exposures and engineering recommendations to mitigate physical climate risks. We continue to evaluate opportunities to apply Chubb’s significant internal modeling capabilities and external partnerships to enhance the quality and availability of climate-related risk analyses that can serve as the basis of additional climate resilience services.

Developing science-based underwriting criteria for high-emitting industries

Through the underwriting process, we have opportunities to promote good risk management and the adoption of sound engineering practices by our clients. Our strategy seeks to deploy these fundamental areas of expertise to address the high-emitting industries we insure. Our approach to these industries involves conducting our own review of best practices, seeking guidance from non-governmental organization (NGO) partners, and engaging with our clients to develop perspectives on GHG emissions mitigation measures that apply best engineering practices and relate to risk quality. As we deploy underwriting criteria, we will simultaneously offer our on-the-ground engineering expertise, working on-site with our clients to help deploy best practices and controls to reduce greenhouse gas emissions.

We applied this approach to the development of our oil and gas underwriting criteria. We are currently evaluating opportunities for additional criteria for oil and gas and assessing the potential evidence to support the development of criteria in other high-emitting industries.

Oil and Gas Underwriting Criteria and Conservation Policy. In March 2023, Chubb announced the following underwriting criteria and conservation criteria that apply to oil and gas extraction projects.

- Standards for methane emissions. Chubb will continue to provide insurance coverage for clients that implement evidence-based plans to manage methane emissions including, at a minimum, having in place programs for leak detection and repair, the elimination of non-emergency venting, and adopting one or more measures that have been demonstrated to reduce emissions from flaring. Clients will have a set period of time to develop an action plan based on their individual risk characteristics. We may decline coverage if a potential policyholder cannot meet our methane performance expectations.

- Standards for protected conservation areas. Chubb will no longer underwrite oil and gas extraction projects in International Union for the Conservation of Nature (IUCN) management categories I-V in the World Database on Protected Areas, which includes nature reserves, wilderness areas, national parks and monuments, habitat or species management areas, and protected landscapes and seascapes that have been designated for protection by state, provincial or national governments. This includes the Arctic National Wildlife Refuge (ANWR). Chubb is currently developing standards for projects in category VI areas (protected areas that allow sustainable use) in the World Database of Protected Areas as well as for oil and gas extraction projects in the Arctic, Key Biodiversity Areas, mangrove forests and global peatlands that are not currently listed in the World Database on Protected Areas.

We will support our clients as they endeavor to improve their methane emissions controls by providing engineering resources and support through Chubb Risk Engineering. We have created and will continue to expand the Chubb Methane Resource Hub as a central location for resources and support for our insureds.

Chubb Methane Mitigation Resource Hub

Chubb developed and launched the Chubb Methane Resource Hub, a digital resource to support the company’s oil and gas clients in identifying and adopting methane emissions reduction technologies. The hub includes a library with reports and readings on measurement and mitigation opportunities, methane measurement studies, regulations and voluntary programs. Clients can also find a directory of service providers that can facilitate methane emissions reduction activities.

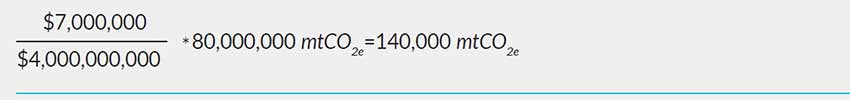

Assessing our Exposure to Climate-related Risks

We consider a wide range of risks related to climate change, from the effect of increased wildfire and storm intensity on property claims to the potential effect that changing energy usage may have on the fossil fuel industry’s insurance demand. Underlying our climate change risk assessment is the fundamental fact about the insurance industry: Most insurance policies are issued on an annual basis, meaning that we have the ability to quickly adapt our underwriting strategies to emerging climate risks. This means, for example, that we can respond to increased claims risk (e.g. from wildfires or hurricanes) with rates and geographic limitations on exposure that reflect that increased risk. It also means that we can quickly adjust our underwriting strategies to, for example, focus on new business opportunities in clean energy, as we are doing with Chubb Climate+.

As we manage climate risk, Chubb closely follows emerging trends in climate litigation. For example, the risk associated with “greenwashing” and “impact washing” — the false or misleading impression regarding the environmental and sustainability practices, policies, products, activities, etc., of a company — is increasing, particularly with expanding regulatory focus. Alleged corporate greenwashing and other alleged ESG-related misrepresentations by companies from many sectors have received scrutiny by a wide range of interested parties. Chubb is monitoring these risks on its insurance products, in particular directors and officers (D&O) liability coverages. We continue to evaluate these risks in transition-exposed industries and have provided extensive training to our global D&O underwriters about the risks presented by climate change. We seek to manage our exposure through limits management, appropriate pricing and coverage terms.

We conduct extensive analysis of the risks related to how climate change may be altering the frequency and severity of natural catastrophe events. We maintain a large internal team of natural catastrophe modelers who regularly assess the potential for climate-driven changes in the frequency and severity of losses. We quantify these risks on an annual basis through the Probable Maximum Loss (“PML”) calculation, which is described in more detail below.

Our Enterprise Risk Unit supports Climate Change Scenario testing across Chubb’s global operations. The ERU is working to develop a unified approach to climate scenario analysis that can be applied across Chubb’s operations. The scenarios under assessment rely on the IPCC RCP4.5 and RCP8.5 scenarios for physical climate impacts, as well as multiple transition scenarios over short, medium and long-term timeframes, and the Network for Greening the Financial System (“NGFS”) scenarios for both transition and physical risks. We assess the impact of physical, transition and liability risks over modeled timeframes.

Managing Property Insurance Risk Exposure

Risk Selection

- Management determines risk tolerance and appetite

- Physical risk exposures evaluated

- Underwriters assess risk of a loss during policy term (1 year)

- Risk assessed at individual policy and portfolio levels

- Exposure of the insured to transition risk*

Risk Transfer

- Policy terms, conditions and premium set to achieve a reasonable risk-adjusted return

- Insurer binds policy

- Policies are 100% premium earned (insured pays full premium at the start of the risk term)

*Chubb considers transition risk to be part of the risk selection process because we do not anticipate sudden transition risks that will manifest during the one-year policy term

The Intergovernmental Panel on Climate Change (IPCC) has published several trajectories of global warming, which are used to inform scenarios assessed across the financial services industry. We are evaluating the IPCC’s extreme climate change scenario (RCP 8.5), which represents a 4.5ºC temperature rise by the end of the century, to provide a broad range of outcomes. The impacts of this scenario are layered on our existing natural catastrophe perils. We have licensed the RMS (industry standard natural catastrophe model vendor) forward-looking climate views for U.S. hurricane, which is the largest contributor to our Worldwide Aggregate PML, and will be evaluating additional climate solutions for other key perils.

We also model the impact of transition risk on the investment portfolio and assess liability risk based on exposure by sector. The assumptions for this modeling leverage NGFS published scenarios, which cover multiple transition and physical risk paths. Parameters are translated to specific investment portfolio related shock assumptions by country.

We work extensively to understand the potential climate impacts to our view of risk and to meet regulatory requirements. For near-term business planning decisions (less than one year), we confirm model appropriateness for current climate risks by endeavoring to appropriately incorporate recent trends, loss experience and changing exposure patterns. For example, it appears that climate change has likely resulted in an increase in storm surge from sea level rise as well as an increase in tropical cyclone precipitation. Separately, there is also likely higher U.S. wildfire and inland flood risk. We have stress tested our U.S. wildfire model and the potential impacts of reduced precipitation/snowpack, and longer and more intense wind seasons. The results of this analysis have had a substantive impact on our business in certain U.S. western states, including how we view the evolving nature of wildfire risk in terms of concentrations of that risk in the wildland-urban interface.

For long-term (five-plus years) impacts, we utilize vendor models to assess the impacts of the IPCC scenarios on modeled losses for key region perils such as U.S. hurricane, with a focus on the (RCP) 8.5 scenario.

We also assess the impacts of climate change on our operations beyond natural catastrophes, for instance through the implications of regulatory, legislative and legal activity, and other market activity impacting our clients or the credit and market risk of our investment portfolio.

Our investment strategy focuses on asset allocation and relies on outside asset managers to direct securities selection and execution. Most of our investments are in bonds with maturities typically five years or less. As a result, individual portfolio holdings are constantly changing over time and are less impacted by the long-term effects and company-specific risks associated with climate change. They are helping us understand their climate risk management strategies, how they are applied to our assets, and what data are available to us to understand the climate alignment of our investment portfolios. We are also implementing BlackRock’s Aladdin portfolio management software, which includes climate data oversight capabilities via integration with other third-party providers’ TCFD data metrics. We regularly evaluate opportunities to invest in funds and companies that target climate solutions, including in the areas of decarbonization, energy efficiency, resource conservation and emissions management. We will continue to seek opportunities in these areas that are consistent with our broader investment management objectives.

Seeking External Advice to Shape our Climate Strategy

Chubb values the expertise and input of external collaborators as we continue to develop our climate strategy. We actively seek to build external partnerships and engage with our clients.

In 2022, we engaged with the Environmental Defense Fund (EDF), a globally leading, science-focused, environmental NGO, and their experts in the oil and gas and insurance sectors. EDF provided technical expertise to support the identification and development of resources for the newly launched Chubb Methane Resource Hub to support our oil and gas clients in reducing their methane emissions. We plan to continue our conversations with EDF to evaluate best practices around methane in the oil and gas industry, and we anticipate that we will continue to draw on EDF’s expertise as we expand our work to evaluate emissions reduction opportunities in other high-emitting industries.

In addition, we sponsored a series of workshops in 2022 and 2023 facilitated by the University of Pennsylvania to further the conversation between insurance companies, investors, regulators, emissions measurement groups, academics and other stakeholders around how the insurance industry can assess and track climate risk and opportunities and develop meaningful metrics to communicate progress. We will continue our sponsorship of workshops with Penn this year with the intention of connecting regulators, insurance companies and investors to continue the dialogue around facilitating the transition to a net-zero economy.

Risk Management

Identifying and Assessing Climate-Related Risk

The consequences of climate change comprise numerous perils and hazards, and multiple risks and opportunities. Climate risk identification involves evaluation of the various risks to which Chubb is exposed as a result of our business profile and the external environment within which we operate. We provide an extensive description of our overall ERM process in Chubb’s annual proxy statement.

Chubb’s risk appetite is defined through risk guidelines, authorities and policies and drives underwriting and risk mitigation actions. Natural catastrophe risk is managed through risk tolerances across multiple measures (capital, earnings, liquidity, industry loss share) to serve various objectives, and encompasses our exposure across all worldwide peril regions. As climate change and weather patterns drive the size of our exposure to natural catastrophe risk, we have performed extensive analysis to understand potential impacts on our assessment of the risk. In case of perils such as wildfire, where there is likely impact of climate change on the risk, we adjust our models to account for recent trends and apply a forward-looking view of the risk. We also determine the need for underwriting actions to manage exposure in concentration zones. In addition, we have issued policies limiting exposure to coal and oil sands.

ERM efforts are defined in terms of time horizon and business materiality. Chubb’s ERM discipline is defined as the process to identify, assess, mitigate and monitor those risks that, if manifested, might impact Chubb’s exposure footprint (investments, operations and short/long-tail liabilities) such that our ability to achieve our strategic business objectives might be impaired. Chubb considers 36 months as the period during which we conduct our strategic ERM planning, but actual execution, and risks associated with that execution, has a one-to-two-year focus (short-term). Medium-term time horizons are two-to-five years, and long-term is five-plus years.

Catastrophe Modeling. Chubb evaluates and manages its exposure to natural catastrophes (and therefore physical climate risks) through the use of catastrophe modeling. Increased catastrophe losses in recent years highlight the increasing vulnerability of the ever-growing concentration of humans and property values on coastlines and in the urban-wildland interface. The very presence of human and property assets in areas such as these means extreme weather conditions can quickly turn into catastrophes.

Chubb is a leader in the use of catastrophe models to quantify natural catastrophe risk for product pricing, risk management, capital allocation and estimation of losses. Chubb uses models to aggregate and closely monitor natural catastrophe exposures across our global portfolio and to ensure our capital base is sufficient to meet the expectations of regulators, rating agencies and policyholders, and to provide shareholders with an appropriate risk-adjusted return.

Chubb uses internal and external data together with sophisticated analytical, catastrophe loss and risk modeling techniques to ensure an appropriate understanding of risk, including diversification and correlation effects, across different product lines and territories. We continually adjust our processes to address climate and weather pattern changes.

Chubb’s risk analysis ranges from the known (based on definitive historical loss experience) to the hypothetical (based on a probable maximum loss calculation). At present, our scenario analyses are modeled on a one-year time horizon to inform underwriting and business planning decisions, though we stress test our portfolio against multiple climate scenarios over a longer timeframe, as described in the Strategy section of this report. We continually assess and improve our modeling capabilities by utilizing our own loss experience, leveraging industry loss experience and expertise, as well as through academic partnerships. Through these efforts, we remain at the leading edge of assessing trends in frequency and severity of natural perils such as wind, flood and wildfire, and therefore incorporate them in a timely manner into pricing, underwriting and risk management decisions.

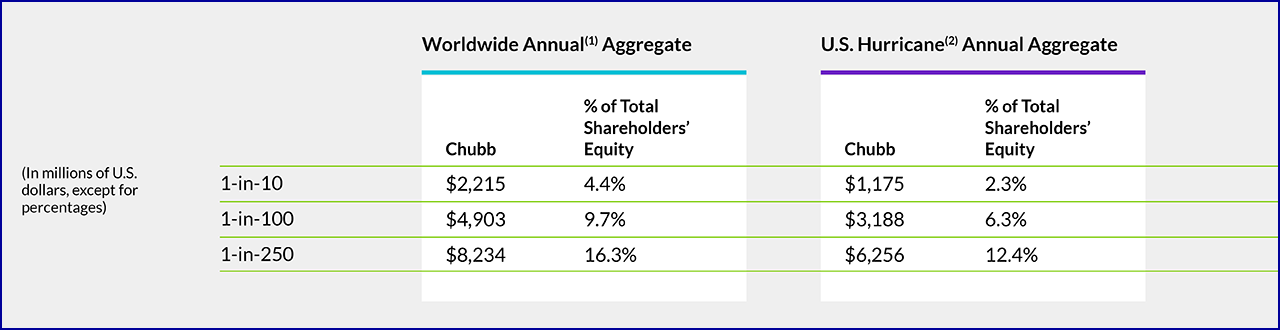

Probable Maximum Loss Calculation

Chubb uses probable maximum loss calculations to estimate the maximum loss, in millions of dollars and translated to percentage of shareholders’ equity, that would occur from modeled natural catastrophes in a given year. With sophisticated modeling and the knowledge of internal and external scientists, we calculate the probability of different types of natural catastrophes to occur in one year and the likely dollar amount of claims should they occur.

Absolute dollar amounts of PML may change over time with increased market share and premium written, but we endeavor to keep consistency in PML as a percentage of total shareholders’ equity by managing our portfolio of business to handle expected losses. Because we have captured current-day impacts of climate change into our catastrophe modeling, and iteratively assess such impacts, PML calculations demonstrate business readiness to absorb physical losses from climate change. The table below presents our modeled pre-tax estimates of natural catastrophe PML, net of reinsurance, at December 31, 2022, and does not represent our expected catastrophe losses for any one year.

The PML is a reflection of our exposure to physical climate impacts on our insureds during the policy period, and provides us with a tool to identify and manage the risks from those exposures.

Modeled Net Probable Maximum Loss (PML) Pre-tax

(As reported in the Chubb Limited 2022 Annual Report)

(1)Worldwide aggregate is comprised of losses arising from tropical cyclones, convective storms, earthquakes, U.S. wildfires, and floods in the U.S., Canada, and Europe, and excludes “non-modeled” perils such as man-made and other catastrophe risk, including pandemic.

(2)U.S. hurricane losses include losses from wind, storm-surge, and related precipitation-induced flooding.

Managing Climate-Related Risk

Chubb employs a variety of tools and strategies to manage climate-related risks in our business operations. These range from fundamental features of the underwriting process to specific exclusions and underwriting criteria that address certain high-emitting industries.

With respect to the core underwriting process, there are several key risk management tools we employ that apply to all risks, including climate risks. First, as explained in the Strategy section above, our relationships with our insureds are typically governed by one-year contracts.

Consequently, we can quickly respond to changes as needed by adjusting our pricing or by restricting our exposure. As part of its typical underwriting process, Chubb regularly assesses the nature of the risks we are covering, including assessing changes in the insured, its operations and exposures that will naturally extend to climate risks. In addition, we mitigate our exposure to climate change risk by hedging catastrophe risk in both the reinsurance and capital markets.

Beyond these ordinary-course underwriting practices, we apply a number of underwriting criteria and exclusions that set forth specific underwriting practices for certain high-emitting industries.

Underwriting Criteria. As part of its new underwriting criteria for oil and gas extraction projects, Chubb will require clients to reduce methane emissions. Chubb is developing metrics to share externally on the implementation of these criteria and the subsequent avoided emissions. For more details on the Oil and Gas Underwriting Criteria, refer to the Strategy section of this report.

Coal Policy. Chubb was the first major insurer in the U.S. to announce a policy concerning thermal coal-related underwriting and investment. On July 1, 2019, we adopted the following policy:

- Chubb no longer underwrites risks related to the construction and operation of new coal-fired plants.

- Chubb does not underwrite new risks for companies that generate >30% of revenues from thermal coal mining and phased out coverage of existing risks that exceed this threshold at the end of 2022.

- Chubb does not underwrite new risks for companies generating more than 30% of their energy production from coal and began phasing out coverage of existing risks exceeding this threshold at the start of 2022 (accounting for the viability of alternative energy sources in the impacted region).

- Chubb no longer makes new debt or equity investments in companies that generate more than 30% of revenues from thermal coal mining or that generate more than 30% of energy production from coal.

Oil Sands Policy. In 2022, Chubb adopted a policy that it will no longer underwrite risks for projects involving direct mining or in-situ extraction and processing of bitumen from oil sands.

Investment Management. We apply the same risk management rigor to our broadly diversified fixed income investment portfolio as we do to our underwriting practice. Our portfolio, which backs the loss reserves and claims-paying ability of our insurance businesses, is highly diversified by risk, industry, location and type and duration of security. For example, asset concentrations are carefully managed in hurricane- and flood-exposed areas. The impact of climate risk on underlying credits will naturally be an increased factor in our investment decision-making over time given the future impact on certain long-dated asset classes, such as mortgages and municipal bonds. Our portfolio is relatively short-dated, with an average duration of less than four years.

Risk Engineering. Chubb’s more than 600 risk engineers work with our commercial and consumer clients to moderate the risks from climate change perils and make them more resilient. The company brings deep technical knowledge to this work, from providing guidance on construction standards, wildfire land management, and coastal protection to the development of lithium battery storage systems. We advise policyholders in catastrophe-prone areas of potential mitigation and adaptation actions that could help reduce their risk exposure. Chubb also provides risk engineering services to help clients mitigate supply chain and global operations risks from exposures related to a changing climate. For example, Chubb provides wildfire mitigation consultation (such as vegetation management evaluations with geo-mapping and drone-based tools) to businesses and homeowners at elevated or increasing risk from wildfires. Chubb also advises clients on broader resiliency efforts. For example, during the fourth quarter of 2022 and into 2023, we engaged with certain of our U.S.-based publicly traded clients regarding how the proposed SEC climate reporting requirements may impact their D&O exposure and proposed Chubb Risk Engineering services to support their efforts to assess the physical risk of climate change.

Supporting our Clients in Climate Hazard Mitigation through Risk Engineering

As storm events approach, our risk engineering team regularly communicates with our clients to alert them to upcoming hazards and the steps they can take to mitigate losses. In the days leading up to Hurricane Ian, Chubb Risk Engineering prepared information on projected storm tracks and provided resources from the Chubb Catastrophe Center on storm preparedness and safety during and after storm events.

Metrics and Targets

New Operational Greenhouse Gas Reduction Goals

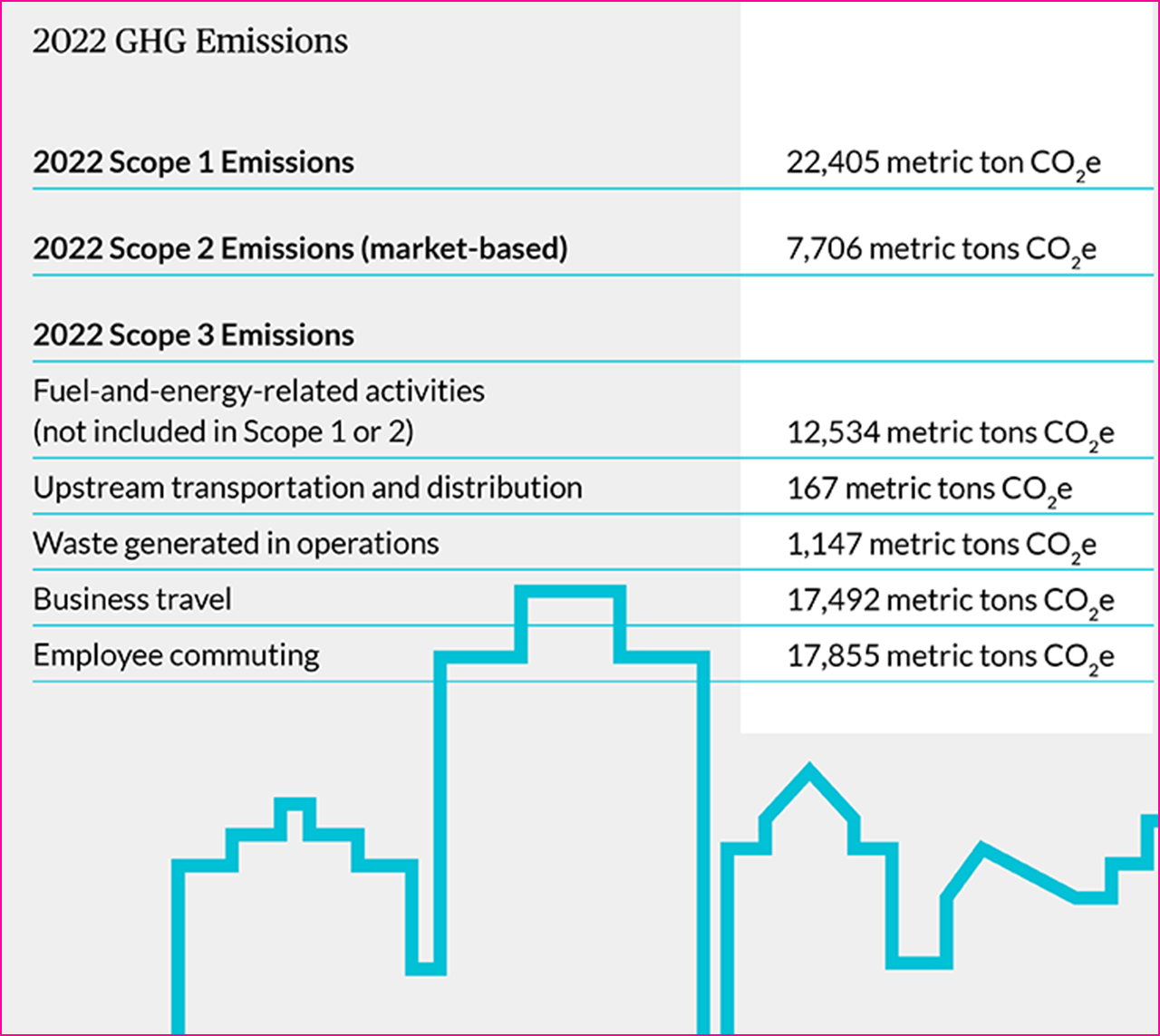

We are in the process of assessing and defining new operational greenhouse gas reduction goals. As part of our strategy, we seek to reduce or avoid entirely the purchase of carbon offsets, and instead invest in emissions reductions and the direct purchase of renewable energy where possible. We anticipate sharing our new operational greenhouse gas goals later this year.

Since 2015, Chubb has purchased renewable energy as our source of electricity for our real estate portfolio in the U.K. and since 2020 for a majority of its portfolio in the U.S. via the use of renewable energy credits. In 2021, these programs reduced Chubb’s Scope 2 GHG emissions by 6,947 metric tons of CO₂e.

Insuring the Transition. Chubb Climate+ is currently in the process of finalizing data on the growth of our practice in the first half of 2023. We expect to provide metrics on our progress in insuring the transition through Chubb Climate+ later this year.

Engaging on Methane. As discussed in the Risk Management section of this report, Chubb introduced underwriting criteria for oil and gas producers in 2023. Through July 1, 2023, we engaged with 59 oil and gas producers regarding our methane criteria as part of the renewal process. The key outcomes of these engagements were:

- 49 clients had leak detection and repair plans in place

- 51 clients provided us plans to eliminate routine venting

- 52 clients provided us with plans to manage flaring

Our engineering team is currently in the process of evaluating the initial plans provided by our insureds to continue to develop our knowledge base on best practices for methane controls.

We have undertaken initial efforts to assess the methane emissions of the clients we have engaged with as part of the renewal process. We have been able to obtain methane emissions data for 32% of these clients. Within the category of clients for which we have data:

- 16 provide some level of direct measurements of methane emissions

- Eight provide methane emissions calculated using emissions factors, such as EPA’s Subpart W rules under the Mandatory Reporting Rule

Studies suggest that methane emissions inventories generated using emissions factors have a tendency to significantly underestimate actual emissions and can mis-identify the equipment that is the most significant source of methane emissions at particular well sites. As a result, we are exploring opportunities to support the development of more accurate methane emissions inventories to improve data quality and better assess the relationship between our underwriting criteria and the methane emissions of our insureds.

Chubb first developed its Corporate Greenhouse Gas Inventory Management and Reduction Plan in 2007, when we joined the voluntary Climate Leaders initiative sponsored by the U.S. Environmental Protection Agency (EPA). We continue to use methodology based on the World Resources Institute and the World Business Council for Sustainable Development (WRI/ WBCSD) GHG Protocol for data collection and analysis for Scope 1, Scope 2 and some Scope 3 GHG emissions. Chubb’s emissions are third-party verified to ISO 14064–3 standards.

Engaging with our large clients on climate and transition: One of our most important vehicles to engage with our large clients is our Client Advisory Board process. Our Client Advisory Board meetings are held regionally in the U.S. and at the country/regional level in our overseas operations. At these meetings, we take the opportunity to share information on emerging risk management trends with our largest clients and solicit their feedback. In the fall of 2022, our U.S. Client Advisory Board agenda included a session on climate and ESG risks in relation to directors and officers of companies. This session covered the evolution of ESG, its prominence as a boardroom topic, greenwashing and practical tips for managing the risk of ESG. Throughout 2023, our Chubb Overseas Group Client Advisory Board agendas have featured a discussion of Chubb Climate+ and engagement with our large clients on how we can provide capacity and risk management services to support their investments in the net-zero transition. Through the Client Advisory Board processes, we have engaged with over 270 clients regarding climate change.

We have also begun to hold individual meetings with our clients to better understand their transition plans and how we can provide the risk transfer capacity needed to support the net-zero transition.

Looking Ahead

We are pleased to share the progress we have made with our climate programs in the past year. Over the next year, we plan to maintain our focus on growing Chubb Climate+, expanding the products and services we offer to support the net-zero transition. We will continue to apply a science-based approach to the development of underwriting criteria for high-emitting industries, and couple the development of new criteria with engineering support to assist our clients. We will continue to assess options to improve the availability and quality of emissions data for our insureds in sectors where we define underwriting criteria and evaluate metrics to report on our progress.

In 2024, we are also looking forward to the publication of our first sustainability report. We continue to evaluate potential sustainability reporting frameworks, and we will provide updates on our climate progress as appropriate in our sustainability reporting early next year.

Additional Information

Chubb Resources

Chubb Responses to NAIC Closed-End Questions

| NAIC Survey Question | Chubb Response | Reference(s) |

| 2. Does the insurer have publicly stated goals on climate-related risks and opportunities? | Yes | See generally “Strategy,” Pages 4-7 |

| 3. Does your board have a member, members, a committee, or committees responsible for the oversight of managing the climate-related financial risk? | Yes | See “Board of Directors Oversight” and “Management Responsibilities,” Page 3 |

| 4. Does management have a role in assessing climate-related risks and opportunities? | Yes | See “Management Responsibilities,” Page 3 |

| 5. Does management have a role in managing climate-related risks and opportunities? | Yes | See “Management Responsibilities,” Page 3 |

| 6. Has the insurer taken steps to engage key constituencies on the topic of climate risk and resiliency? | Yes | See: “Chubb Climate+: Underwriting for the Transition and Engineering for Resilience,” Page 4 “Developing science-based underwriting criteria for high-emitting industries,” Page 5 “Seeking External Advice to Shape our Strategy,” Page 7 See also: “Insuring the Transition” and “Engaging on Methane” under “New Operational Greenhouse Gas Reduction Goals,” Page 11 “Engaging with our large clients on climate and transition” under “Metrics and Targets,” Page 12 |

| 7. Does the insurer provide products or services to support the transition to a low carbon economy or help customers adapt to climate risk? | Yes | See: “Chubb Climate+: Underwriting for the Transition and Engineering for Resilience,” Page 4 “Developing science-based underwriting criteria for high-emitting industries,” Page 5 |

| 8. Does the insurer make investments to support the transition to a low carbon economy? | Yes | See: “Assessing our exposure to climate risks,” Investment discussion: Page 7 |

| 9. Does the insurer have a plan to assess, reduce or mitigate its greenhouse gas emissions in its operations organizations? | Yes | See “New Operational Greenhouse Gas Reduction Goals,” Page 11 |

| 10. Does the insurer have a process for identifying climate-related risks? | Yes | See “Identifying and Assessing Climate-Related Risk,” Pages 8-9 |

| 11. If yes, are climate-related risks addressed through the insurer’s general enterprise-risk management process? | Yes | See generally: “Governance,” Page 3 “Risk Management,” Pages 8-10 |

| 12. Does the insurer have a process for assessing climate-related risks? | Yes | See: “Assessing our exposure to climate risks” under “Strategy,” Pages 6-7 “Identifying and Assessing Climate-Related Risk” under “Risk Management,” Page 8 |

| 13. If yes, does the process include an assessment of financial implications? | Yes | See “Probable Maximum Loss Calculation” under “Risk Management,” Page 9 |

| 14. Does the insurer have a process for managing climate-related risks? | Yes | See “Managing Climate-Related Risk” under “Risk Management,” Pages 9-10 |

| 15. Has the insurer considered the impact of climate-related risks on its underwriting portfolio? | Yes | See generally “Risk Management,” Pages 8-10 |

| 16. Has the insurer taken steps to encourage policyholders to manage their potential climate-related risks? | Yes | See: “Chubb Climate+: Underwriting for the Transition and Engineering for Resilience,” Page 4 “Developing science-based underwriting criteria for high-emitting industries,” Page 5 See also: “Coal Policy” and “Oil Sands Policy” under “Risk Management,” Page 10 “Insuring the Transition” and “Engaging on Methane” Page 11 |

| 17. Has the insurer considered the impact of climate-related risks on its investment portfolio? | IN PROCESS | See: “Assessing our exposure to climate risks,” Investment discussion: Page 7 |

| 18. Has the insurer utilized climate scenarios to analyze their underwriting risk? | Yes | See “Catastrophe Modeling” under “Risk Management,” Page 8 |

| 19. Has the insurer utilized climate scenarios to analyze their investment risk? | Yes | See “Assessing our Exposure to Climate Risks,” Page 7 |

| 20. Does the insurer use catastrophe modeling to manage your climate-related risks? | Yes | See “Catastrophe Modeling” under “Risk Management,” Page 8 |

| 21. Does the insurer use metrics to assess and monitor climate-related risks? | Yes | See “Metrics and Targets,” Pages 11-12 |

| 22. Does the insurer have targets to manage climate-related risks and opportunities? | Yes | See “Metrics and Targets,” Pages 11-12 |

| 23. Does the insurer have targets to manage climate-related performance? |

Yes | See “Metrics and Targets,” Pages 11-12 |

Important Legal Information

The data contained in this report is for general informational purposes only. Investors are cautioned that certain statements in this report are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements often use words such as “estimate,” “expect,” “intend,” “plan,” “believe,” and other words and terms of similar meaning, or are tied to future periods in connection with a discussion of future operations or performance. These statements include, among other things, statements about our investment portfolio, our new product offerings, our market risk, our risk management, including climate-related risks and opportunities, as well as catastrophe losses and modeling, and commitments. No warranty, guarantee or representation, either expressly or implied, is made as to the correctness or sufficiency of any material contained herein. Forward-looking statements are subject to certain risks, assumptions and uncertainties, and actual events and results may differ materially from those expressed, envisioned or discussed herein. We undertake no obligation to update such forward-looking statements. For a discussion of the assumptions, risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in the forward-looking statements, see our most recent reports on Form 10-K and Form 10-Q filed with the Securities and Exchange Commission.

The inclusion of information in this report should not be construed as a characterization regarding the materiality or financial impact (or potential impact) of that information.

This report contains trademarks, trade names and service marks owned by Chubb Limited and its subsidiaries, including Chubb®, Chubb logo®, Chubb. Insured®. and Craftsmanship®. In addition, this report contains trademarks, trade names or service marks of companies other than Chubb, which belong to their respective owners.

About Chubb

Chubb is the world’s largest publicly traded property and casualty insurance company. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. As an underwriting company, we assess, assume and manage risk with insight and discipline. We service and pay our claims fairly and promptly. The company is also defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index. Chubb maintains executive offices in Zurich, New York, London, Paris and other locations, and employs approximately 40,000 people worldwide.

Additional information can be found at: chubb.com

Published August 2023