Chubb Limited 2022 Annual Report Letter to Shareholders

Evan G. Greenberg

Chairman and Chief Executive Officer | Chubb Group

- The economic and geopolitical environment

- Underwriting outperformance in another active CAT year

- Favorable commercial P&C underwriting conditions

- Rebound in global consumer growth

- Record financial performance in ’22

- Three engines of future earnings growth

- Strong, balanced growth from our commercial and consumer businesses globally

- Two sides of the digital coin: company transformation and digitally native business unit

- The risk environment: staying on top of rising loss costs

- Supporting the transition to a net-zero future

- Trade contributes to America’s economic strength

- he U.S.-China relationship

To My Fellow Shareholders

Chubb had the best financial performance in our company’s history in 2022. We produced record core operating income and continued to capitalize on favorable commercial P&C underwriting conditions around the world while our consumer businesses recovered from the pandemic’s lingering effects. Together, we had another year of double-digit premium revenue growth.

We once again demonstrated our risk-taking prowess in an increasingly perilous world by achieving industry-leading underwriting profitability, including record P&C underwriting income and an 87.6% combined ratio. We produced record investment income and took advantage of rising interest rates and widening spreads to reposition our fixed income portfolio to generate higher future returns. We made excellent progress in our efforts to advance many of our longer-term strategies that position us for future revenue and earnings growth. They include, notably, the acquisition of Cigna’s supplemental health and life insurance business in Asia and the regulatory approval to increase our stake in Huatai Insurance Group in China. Together, they deepen our presence in this fast-growing region, now approaching 20% of the company’s global insurance business.

Altogether, as we look forward, the combination of P&C revenue growth and underwriting margins, growth in investment income, and expansion of our life business in Asia, point to continued operating income and earnings per share (EPS) growth for the future.

In this year’s letter, as I have done in the past, I will describe who we are and our accomplishments and set out the important elements of our strategy and objectives. I will explain why we look to the future with conviction and optimism for the benefit of our shareholders, customers and employees despite the tremendous risk and uncertainty surrounding us globally. Successful companies, in my judgment, operate with clarity of purpose, knowing who they are and why they exist. So, let me begin by describing in just a few words our unique and distinctive company.

Chubb is the largest publicly traded P&C insurance company and among the top five insurers in the world as measured by market capitalization. Ten years ago, we were #13, and since then we have more than tripled our market cap. By the way, 20 years ago we were #24. We are a global insurer, predominantly engaged in all forms of commercial and consumer P&C, with substantial local operations in 54 countries and territories, and we have a sizable and growing Asia life insurance business. Life insurance now represents about 13% of our revenue and earnings if you include a full year of Cigna and Huatai results. We have an enviable long-term track record of financial performance, including growth in earnings and book and tangible book value, which is underpinned by distinguished underwriting and investment performance. At our core, we are first an underwriting company, dedicated to the art and science of taking risk.

Culturally, we are an ambitious and highly disciplined organization — patient in long-term strategy and impatient in execution. Our success navigating the multi-year commercial P&C pricing cycle is an excellent example of strategic patience. In the years leading up to 2019, we shrank exposure, or market share, in those lines where we were not getting paid adequately to take risk and grew in others where we were, all while building our capabilities for future opportunity. Then, when other insurers pulled back because of damage to their balance sheets and income statements from underwriting inadequately priced and structured risk, and as a consequence underwriting conditions became more favorable, we mobilized the organization and turned on a dime from defense to offense. Since 2019, we’ve grown our commercial P&C business by about 40%.

Strategic patience is also exemplified by our two signature transactions in Asia last year. Some 15 years ago, we attempted to acquire Cigna’s accident and health (A&H) and life insurance business in the region but were rebuffed at the time. The regulatory approval to increase our ownership in Huatai to nearly 85% was the culmination of a 20-year effort to gain control of this company.

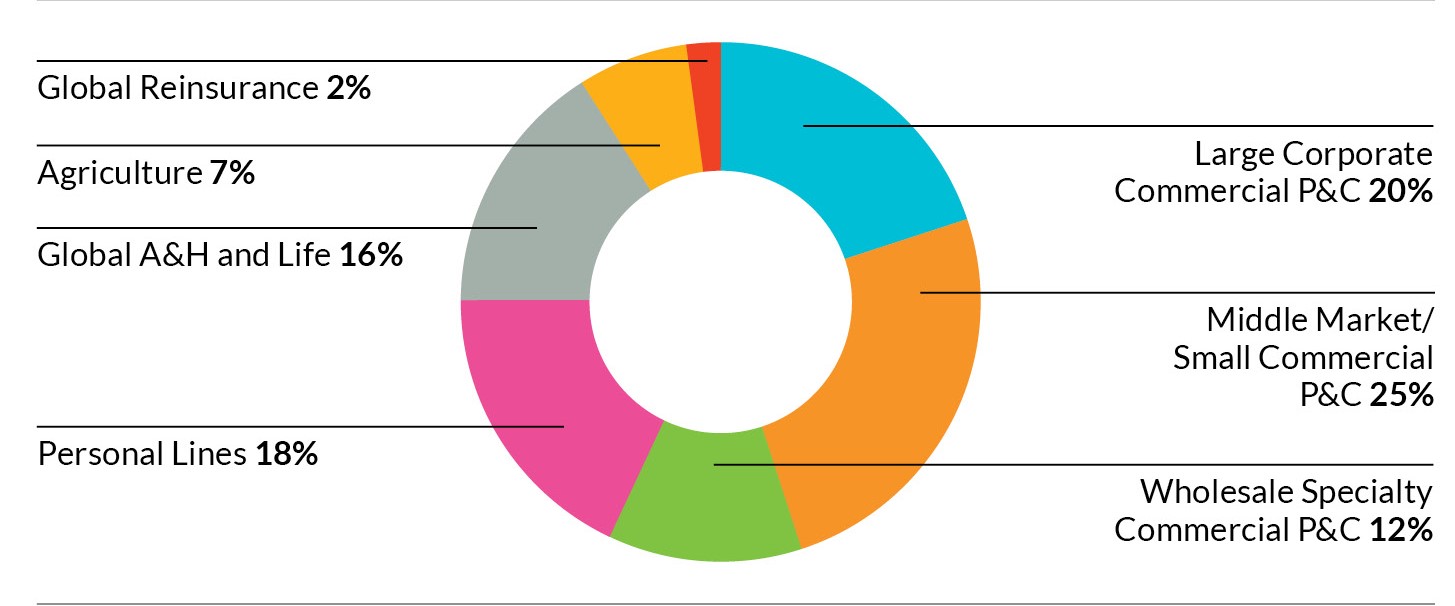

We have thoughtfully constructed and manage a global portfolio of top-performing, multibillion-dollar businesses, with substantial scale and scope for growth. It’s a well-balanced mix of business: 69% comes from commercial lines, where we insure the smallest to the largest companies with more than 200 different property and casualty related products; and 31% from consumer lines, where we insure people’s lives and the things they own — everything from autos to homes and their contents to cellphones. We market through an extensive range of channels designed to reach the target consumer in the most efficient manner. In addition to being an important partner of the largest global brokers, our distribution network spans 50,000 brokers and independent agents, hundreds of thousands of exclusive life and health agents, and hundreds of direct-to-consumer partnerships that give us access to hundreds of millions of existing and potential customers through digital, phone and face-to-face sales.

The economic and geopolitical environment

I would characterize the external environment as complex, uncertain, and with plenty of risk and opportunity for those with the strength to take advantage. In my judgment, inflation in the United States is moderating, but it’s stubborn. Taming inflation, along with financial system stability, will continue to be the principal objective of most central banks. Additional rate increases are very likely, and inflation will remain higher for longer than most think.

We will continue to experience stress in the financial markets coming off an extended period of near-zero interest rates and excessive liquidity — a period marked by excessive and naive risk-taking with asset valuations inflated beyond reason. Substantial leverage, or the carry trade, was employed in search of higher returns. Illiquidity as a risk was ignored by many. Speculative asset prices are adjusting, from crypto to real estate to tech, as they should be, and there is more volatility and stress in financial markets yet to come. How the Fed and Treasury choose to manage between preservation of fundamental economic and financial stability while avoiding bailouts and support for bad behavior is the question. The freedom to fail is part of our system. Our free-market construct depends on striking the right balance.

The U.S. economy is fundamentally strong, and it is broad-based. The odds of recession have grown, particularly given the recent and emerging stress in the financial industry. Looking beyond this moment, the U.S. economy is capable of faster growth, but political partisanship at the federal level holds hostage our ability to address fundamental issues around the increase to our labor force at scale through smart immigration and skills training and, separately, removing regulatory burdens on business, at all levels, that create an unnecessary drag on growth. Faster growth would provide breathing room to invest more in our competitive profile while cutting deficits, meeting our social needs and investing in our military.

Inflation is a global problem and, in addressing it, the specter of recession is rising in numerous areas of the world. In Europe, inflation has become more entrenched, and the impact of the war and energy supply disruption will continue to weigh on its economy. China, while resuming more rapid growth post-pandemic, will likely not return to historic levels given its economic policy, excessive debt levels and shrinking labor force.

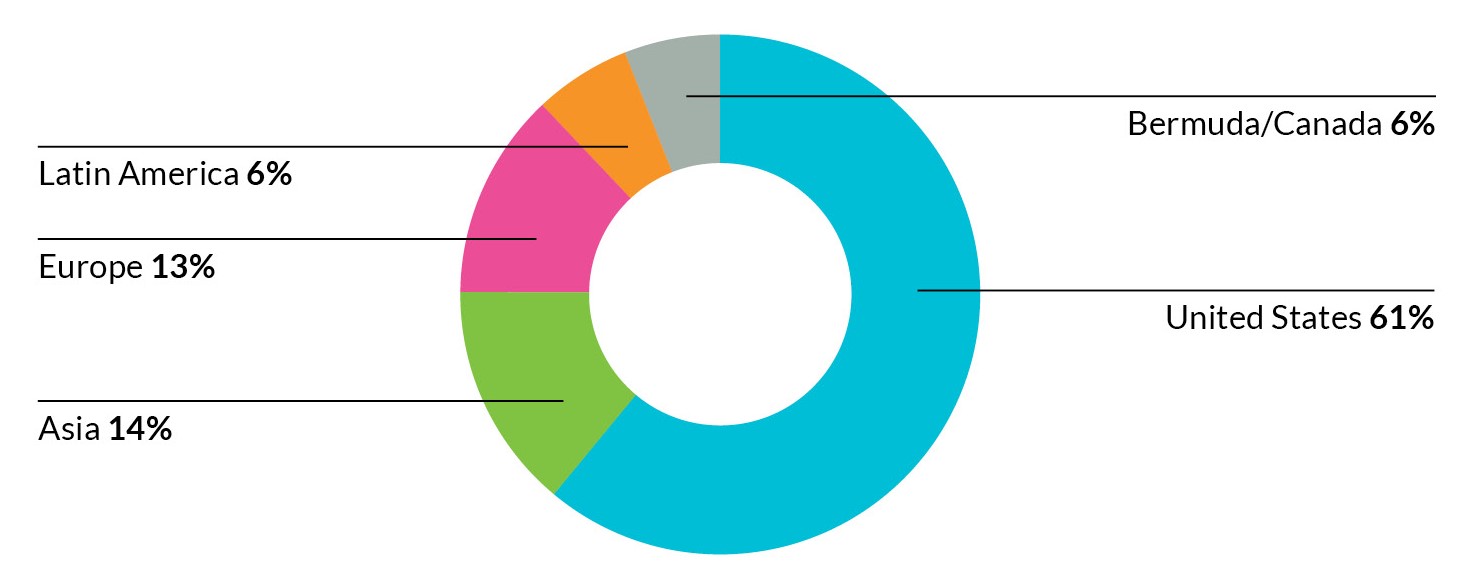

Geographic Sources of Premium

2022 net premiums written

On the geopolitical front, the international system is experiencing growing fragmentation as the world transitions toward an era of greater multipolarity, with the distribution of power shifting around two central poles — the United States and China. In 2022, geopolitical fault lines grew deeper and global stresses more pronounced as great power rivalries involving the U.S., China and Russia intensified. The war in Ukraine has exacerbated global food and energy insecurity and generated spillover social, economic and security pressures across Europe.

The United States passed major legislation intended to strengthen national competitiveness, but which also signaled a shift toward greater protectionism and industrial policy. Meanwhile, technological decoupling accelerated between the U.S. and China. Beijing ratcheted up pressure on Taiwan, and the U.S. and others responded with increased support for Taipei, raising concerns about conflict in the Taiwan Strait. Greater cohesion has been forming among developed nations that collectively share common interests and are confronting China’s use of economic and military power in pursuit of its national ambitions. This pattern of targeted coalition-building is occurring among developed Western and Asian countries, with few developing countries joining such efforts.

Directionally, trade and politics will interact at the international, national and local levels in ways that heighten volatility in 2023. For instance, China will attempt further measures to harden its economy against external vulnerabilities, while Russia likely will intensify efforts to skirt international sanctions and look for China’s support in propping up its economy. In response, China will probably seek to extract benefits from Russia’s dependence but do so in ways that limit the risk of Western sanctions and alienation of Europe. China will aim to attract foreign and domestic private capital, even as Beijing moves toward more state-directed, centralized economic decision-making. The European Union will seek to limit degradation of their economic competitiveness in the face of American industrial policies. The United States will advance efforts to limit China’s access to high-end technologies while it works to reduce an overdependence on critical supplies and seeks the cooperation of European and Asian allies.

Decoupling in high-end technologies will be a market reality raising uncertainties for global supply chains. Amid these shifts, energy markets are reordering in ways that benefit the U.S.

Underwriting outperformance in another active CAT year

Last year was another active year in terms of natural catastrophes (CATs) and one of the costliest on record for the insurance industry. Exacerbated by climate change and urbanization, the industry and society face a growing frequency of costly CATs. It’s part of the new normal — every season of the year is a major CAT season, punctuated by extremes in temperature from hot to cold, moisture from rain and flooding to drought, fire and wind. Industry insured losses last year were estimated at $120 billion, essentially the same as 2021’s elevated level and above the five-year average of $97 billion. For Chubb, our total pre-tax CAT losses in 2022 were $2.2 billion compared with $2.4 billion in 2021 and our five-year average of $2.1 billion.

Our 2022 published calendar year combined ratio of 87.6% compared with 90.9%, 90.8% and 90.1%, respectively, for the three-, five- and 10-year periods. As you can see from the nearby chart, in any period you choose over the past 15 years — or longer for that matter — Chubb’s P&C combined ratio has outperformed our peers, with last year’s outperformance exceeding 5.4 percentage points. As a balance sheet business, wealth creation is measured by growth in book and tangible book value. Since underwriting is our basic business, we strive to never allow our underwriting results to destroy book value.

As a secondary measure of underlying health, our current accident year combined ratio excluding catastrophe losses was 84.2%, compared with 84.8% prior year. Given CATs are growing in frequency and severity, and occur year-round, they are a natural and expected part of a property and casualty insurer’s operating results. While I fully understand the logic, judging an insurer’s results excluding CATs doesn’t make a lot of sense to me. The revenue associated with taking the CAT risk is in the denominator and the losses are excluded from the numerator, so the more levered against CAT exposure, the better the insurer looks. Viewing results excluding CATs is an attempt to see through volatility, which made sense when the volatility was rare, but it is not anymore. The best measure for investors is the published calendar year combined ratio including CATs. It is reality.

Favorable commercial P&C underwriting conditions

For the year, our $29 billion global commercial P&C insurance business produced growth of 11% in constant dollars. Commercial P&C underwriting conditions remained favorable throughout the year with prices adequate to earn an appropriate risk-adjusted return. At the same time, the loss-cost environment has hardly been benign given inflationary pressures, economic and social, and the impacts of climate change. I expect favorable industry underwriting conditions overall to continue and, as I write this, that is the case. However, loss-cost pressures on price adequacy will persist. Insurers need to be mindful, or risk underwriting at a loss. We are now experiencing a reinsurer-led hard market cycle in CAT-exposed property insurance, which is most property.

A rise in reinsurance pricing, reduced terms of coverage and reduced availability of capacity are forcing insurers to assume more exposure and volatility on their balance sheets or to shed risk. This presents an opportunity for us. We are fully prepared to take more risk and, consequently, more volatility — thoughtfully and within reason — as long as we are compensated. It’s a good use of shareholder capital. Given the realities of climate change and the increasing values at risk due to growing urbanization, I doubt these conditions are going away anytime soon.

By the way, I am concerned about a growing public policy problem as a shortage of insurance or reinsurance capacity at reasonable prices is sustained in areas where there is concentration of values; think Florida or California. If states deny insurers the ability to price and tailor coverage adequately and deny them the flexibility to manage their concentration of risk, insurers will continue to shed exposure, which threatens the availability and price of quality insurance. Even with total freedom to price and tailor coverage, there is a limit to how much risk insurers can take and how much people can pay. Climate change is driving insurers to send price signals about the consequences, and that may ultimately contribute to individual behavior in terms of where people choose to live and where businesses choose to locate. There is a cost associated with living in extreme CAT-prone areas. Governments cannot for long force insurers to subsidize this behavior, or do so themselves, and think they can avoid the price. On the other hand, affordability is a real problem for many who simply cannot pick up and move. The issue creates political and social tensions, and there are no easy answers.

P&C Combined Ratio Versus Peers

The company’s underwriting results have outperformed the average of its peers over the last 15 years.

1Includes AIG, Allianz, AXA, CNA, HIG, QBE, TRV, Zurich.

Source: SNL and company disclosures

Rebound in global consumer growth

Growth in our $13 billion global consumer operations picked up as the year went on, recovering from the pandemic’s effects on consumer behavior. In addition to our own capabilities, which we continuously enhance, several macro factors contributed to growth and continue today, though an economic slowdown or recession can impact us temporarily in some areas. For instance, our high-net-worth personal lines business in North America, where we are the market leader, had its best year in terms of growth with net premiums written up 6%. Our sizable A&H direct marketing business based in Asia and Latin America capitalized on reasonably strong consumer credit and purchasing activity, while our global travel insurance business benefited as business and leisure travel resumed. We are investing in capabilities and growing our North America Combined Insurance voluntary benefits business as companies small and large have experienced strong employment growth and business activity. And our Asia life insurance business got a major boost from the Cigna acquisition.

Chubb’s A&H, personal lines and life insurance divisions all experienced upticks in growth in ’22, with total company consumer net premiums written up over 17% in constant dollars. I expect solid growth ahead for our consumer business globally, led by Asia as a result of the newly acquired Cigna and Huatai operations.

Record financial performance in ’22

In sum, our company produced superb full-year 2022 performance, including several record results:

- Core operating income was a record $6.5 billion, or $15.24 per share, up 21% on a per-share basis compared with 2021.

- Record P&C underwriting income of $4.6 billion was up 23%, driven by growth in revenue and margin, leading to an 87.6% combined ratio — a world-class result and an improvement of 1.5 points over prior year.

- Record adjusted net investment income was $4 billion, up more than 8% as a result of rising rates and strong cash flow. Investment income will make up a growing percentage of our company’s earnings as we look forward.

- Total consolidated gross premiums written, which include both P&C and Life, were $52 billion while net premiums written, which are the premiums we retain on our balance sheet, were $41.8 billion, up 13.7% and 13%, respectively, before the impact of foreign exchange. P&C net premiums written grew 10.3% to $38.1 billion, while Life Insurance premiums, which benefited from the midyear Cigna acquisition, grew 52% to $3.6 billion, and are $5.7 billion on an annualized run-rate basis including Huatai Life.

Rising rates and a strong dollar during the year produced sizable mark-to-market losses on our fixed income invested assets, which have temporarily impacted book value in a significant way. For the year, book and tangible book value per share decreased 12.9% and 23.5%, respectively, driven mostly by after-tax net realized and unrealized losses of $10.9 billion in the investment portfolio. Ironically, I view the mark as a good thing because it speaks to future income power. We are predominantly a buy-and-hold, fixed income investor with an average portfolio duration of 4.5 years, so the mark is transitory. In fact, about half of the mark will accrete back to book value over two years.

Our core operating return on equity (ROE) and core operating return on tangible equity last year were 11.2% and 17.2%, respectively. As we look forward, hand in glove with growing income and EPS, and well in excess of our cost of capital that we calculate to be circa 7%, we expect Chubb to generate an ROE of 13%-plus and a tangible ROE of 20%-plus on a deployed capital basis.

Our policy is to manage for capital flexibility — after all, we are a balance sheet business, in the business of risk, and we are ambitious to grow. We maintain flexibility for both and return the balance to shareholders. The last two years are instructive. We organically grew our P&C premiums by 21.5%, and that required capital. We deployed $5.4 billion for the Cigna acquisition and invested a further $1.4 billion to increase our ownership in Huatai, both strategic acquisitions. At the same time, we returned more than $10.5 billion of capital to shareholders through share repurchases (over 9% of outstanding shares) and dividends — all the while maintaining strong capital adequacy given our earnings generation power.

In what was the worst year in more than a decade for global equities and bonds, Chubb shareholders were rewarded in 2022 with 14% appreciation in the stock price and a total return of 16%, outperforming our peer group’s 8% and 12%, respectively, and far superior to the S&P 500’s negative returns. Over three years, our stock has increased 42% with a total return of 50%. Insurance is a long-term business, and attractive long-term shareholder returns are a derivative of doing our job well. In that regard, our 10-year total return of 243% compares favorably to both the S&P 500 (227%) and the S&P 500/Financials (215%).

Next to our people, the balance sheet is our most important asset. We have $66 billion in total capital — up from $33 billion 10 years ago and $9 billion 20 years ago — and $51 billion in equity at December 31. Our company is rated AA by S&P and A++ by AM Best.

Three engines of future earnings growth

Looking forward, our focus is on continuing to grow operating earnings at a healthy rate, which, in turn, will drive EPS. We have three engines of future earnings growth: 1) underwriting income; 2) investment income; and 3) our emerging life division, particularly in Asia.

Underwriting income power is about revenue growth and superior margins. We will continue growing P&C premium revenue by capitalizing on favorable commercial P&C market conditions and advancing our P&C diversification in commercial and consumer lines globally. Our record $4.6 billion of pre-tax P&C underwriting income last year was an annual increase of nearly $1 billion. At Chubb, accountability for underwriting discipline starts at the top: Management owns it and is deeply engaged at every level and in all parts of the organization around the world. We have operationalized our underwriting culture with a balance between local capability and autonomy, as well as global command-and-control oversight, which we have honed over the years without impacting accountability and speed. When we see market opportunity, we strive to quickly seize it.

On the other hand, our willingness to trade market share for underwriting profitability, along with relentless expense management and efficiency, is a competitive advantage. Our expense ratio is superior to the average of other P&C insurers across the market-cap spectrum. Expense discipline is in our culture, and it’s how we operate, but it doesn’t prevent us from investing in our future, including our people, technology and presence in new territories or product areas.

The second engine of our future earnings growth is investment income. After decades of historically low interest rates, the environment changed in ’22 and we entered a favorable period for a fixed income investor. During the year, in response to inflation that reached the highest level in four decades, the U.S. Federal Reserve raised rates seven times, lifting the federal funds rate from 0.25% to a current range of 4.5% to 4.75%, and it will go higher. The age of cheap money is over for a while, and we have capitalized and fully intend to continue.

We were well prepared for the rapid rise in rates. Our $114 billion investment portfolio is 87% fixed income and of high quality and, with a portfolio duration of about 4.5 years, every 100 basis points of increase in our portfolio yield generates approximately $1.1 billion in annualized pre-tax income. Throughout the year, we thoughtfully and meaningfully accelerated the turnover of our portfolio in a targeted manner so that we could put more cash to work more quickly at higher yields. By the end of the year, our reinvestment rate was averaging 5.6%, up from 2.3% in the fourth quarter of ’21. As that higher reinvestment rate found its way into our portfolio, our average yield on invested assets reached 3.6% in the fourth quarter, up from 3.1% prior year, with the average yield on fixed income reaching nearly 4%.

Our growing earning power began to show in the second half of ’22, with quarterly adjusted investment income of about $1.1 billion and our quarterly run rate by the end of the year up $200 million from the prior year fourth quarter — and that momentum will continue to build. Contributing to that increasing investment income was growth in our invested assets, which stood at $113.6 billion at December 31 and was supported by record operating cash flow of $11.2 billion and the addition of approximately $4.5 billion in invested assets from the Cigna Asia acquisition.

With the addition of Cigna’s life insurance companies in Asia and the potential over time for Huatai Life in China, we have added substantially to our life division foundation. We have ambitious plans for this business, which includes Chubb Life, our Asia-based international life insurance business, and our North America-based Combined Insurance affiliate. As an emerging source of operating income and growth, and with an annualized run rate of nearly $6 billion in gross written premiums and earnings approaching $1 billion in ’23, I view our life division as another source of future earnings growth.

Strong, balanced growth from our commercial and consumer businesses globally

Chubb has approximately 34,000 employees operating out of more than 500 offices in the U.S., Europe, Asia, Latin America and other parts of the world. When we consolidate Huatai, they will grow to 40,000 and 1,200, respectively. Let me briefly describe each of our major businesses so that I may bring the company to life for you.

North America

Our North America Insurance franchise, with substantial presence in the United States, Canada and Bermuda, writes about $33 billion in gross P&C premiums annually and is Chubb’s largest business, comprising more than 60% of the company. In the U.S., which represents almost a third of the global insurance market, we are the largest commercial P&C insurer and serve all sizes of companies. Capitalizing on continued favorable underwriting conditions and a resilient U.S. economy, North America had an excellent year in ’22. Net premiums grew 9.7%, with commercial lines up 10.6% and personal lines up 6.2%. Since the beginning of the commercial P&C hard market cycle in 2019, we’ve added about $8 billion of gross premiums to this division while driving down the combined ratio by almost 2.5 points.

Within North America, our Major Accounts division, with $9.8 billion in annual gross premiums, serves America’s largest domestic and multinational corporations and is the #1 insurer not only in terms of size but also in product and service capability, presence and know-how. Major Accounts provides core risk management services, combining sophisticated risk-sharing capabilities for companies that self-insure with a broad range of risk-transfer coverage delivered on a global basis through our extensive international network. Coverage includes all forms of property and liability-related products, from traditional P&C to specialties such as directors and officers (D&O) and errors and omissions (E&O) to excess casualty and cyber. While 98% of the Fortune 1000 are already Chubb clients, we have billions of dollars of opportunity available over time by writing more coverage for each customer: About half of our largest 4,000 U.S. clients buy three or fewer coverages from us. Major Accounts benefited from continued favorable market conditions last year and grew net premiums by about 8.5%.

With $7.9 billion of annual gross premiums, Commercial Insurance is our North America division that serves middle-market companies, where we are the #3 provider, and small businesses. The division grew net premiums 8% in 2022. This is a vast segment of the economy, ranging from publicly traded mid-size multinational organizations to single-location private companies and everything in between. For middle-market companies, we offer core P&C products complemented by more than 35 specialty coverages, along with expertise and risk engineering services tailored to 25 industries, from healthcare and construction to life sciences and technology, all delivered through an extensive local branch and regional network. In ’22, we launched a dedicated product and service offering targeted to the lower middle market — a relatively undeveloped customer segment for Chubb historically. We are building a fully digital division focused on small companies that offers a highly automated experience — from solicitation to data ingestion to quoting to issuance to claims and servicing via agent self-service tools.

We have a significant position in the U.S. excess and surplus (E&S) insurance market for hard-to-place risks through our Westchester division. Westchester writes more than $4 billion in annual gross premiums through wholesale brokers and has capitalized on the hard market with net premium growth of 53% since 2019. The business offers a broad range of coverage, including property, casualty and specialty products such as construction, financial lines, cyber and product recall. Last year, Westchester’s net premiums increased 11%, and this trading business is well-positioned to grow in current market conditions.

The original ACE company founded in 1985, Chubb Bermuda specializes in excess or high limits of liability and property protection for some of the largest corporations. Complementing our Major Accounts team, Chubb Bermuda rounds out large global insurance programs for companies in industries such as pharmaceuticals and energy that are exposed to class action litigation-related claims and other legal exposures. A subsidiary of Chubb Bermuda is the political risk specialist firm, Sovereign Risk. Sovereign and sister company Chubb Global Markets in London together make us one of the largest political risk and cross-border trade credit underwriters in the world — a specialized field that was in the spotlight in ’22 given ongoing geopolitical tensions.

With about 20% market share and 88 million acres insured, Chubb is the #1 provider of multi-peril crop insurance in America through our Rain and Hail affiliate, founded in 1919. We also have a growing P&C agribusiness that serves the nation’s farming and ranching communities. Together, these operations make up our Agriculture division, which writes $4.4 billion of gross premiums annually. Net premiums were up 21.7% last year and can fluctuate up and down based on commodity prices. Crop insurance is a CAT-like business, vulnerable to weather volatility, and we produced reasonably good financial results in below-average crop conditions. Crop insurance is a public-private partnership with the U.S. government, and we operate a sophisticated, highly automated, data-rich business with skilled professionals, most of whom come from an agricultural background.

Chubb Personal Risk Services (PRS) is the #1 insurer to high-net-worth individuals and families in North America. With $6 billion of gross annual premium, Chubb leads this niche category — which we created more than 35 years ago — and today we have an estimated market share of about 60% among the specialist insurers that serve this category. We carefully tailor a collection of underwriting, engineering, appraisal and claims-related services to best handle these discriminating clients’ complex personal risks — from multiple homes, boats and planes to fine art, jewelry and other valuables to personal liability. These exposures are growing for our clients, and so is their demand for insurance, and we are well-positioned to serve them. In return, we’ve earned tremendous loyalty: With more than 90% annual retention by customer and 99% by premium, PRS exemplifies the Chubb brand’s reputation for quality in America. Our focus on the top high-net-worth Signature and Premier clients, who value rich coverage and exceptional service more than price, resulted in net premium growth of 12.5% last year.

With rising healthcare costs and financial protection an increasing concern for employers and employees, Combined Insurance is our growing worksite benefits business. The business has two distribution channels that offer supplemental A&H and life voluntary benefits plans. A team of more than 2,200 independent agents focus on small businesses, and they grew annualized sales 16% in 2022, while Chubb Workplace Benefits caters to mid- and large-market employers through brokers and grew annualized new business by 17%. Many of Combined’s agents, by the way, are veterans, and the company was recognized as one of America’s top Military Friendly® Employers by VIQTORY in 2022 for the fifth consecutive year.

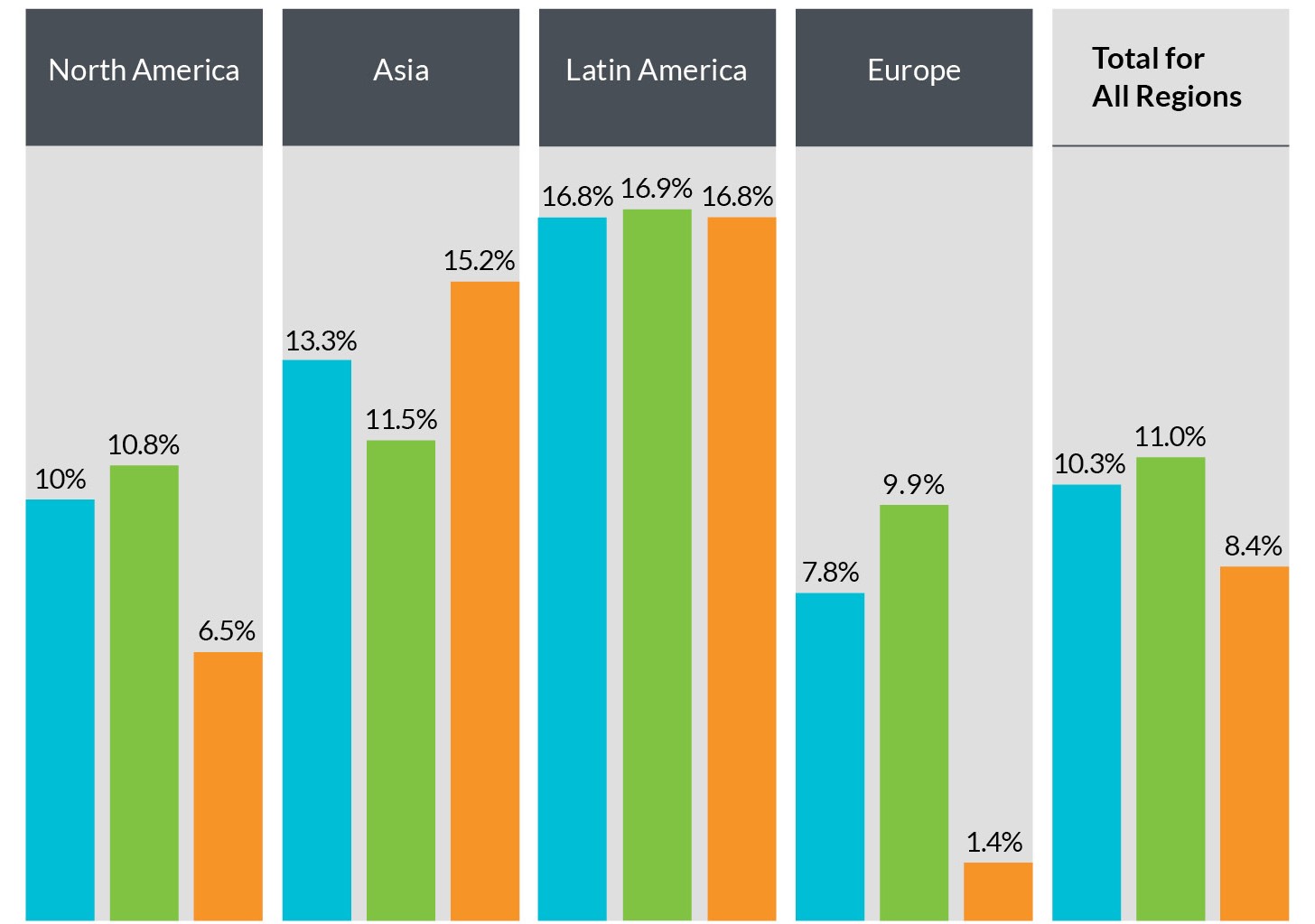

Premium Growth by Geography

Percentage change in P&C net premiums written in 2022 versus 2021 in constant dollars

Data excludes net premiums written from the Life segment

Key

![]() Overall growth

Overall growth ![]() Commercial businesses

Commercial businesses ![]() Consumer businesses

Consumer businesses

International

Almost 40% of Chubb’s gross premiums last year, or $19.7 billion, originated outside the U.S. Beyond North America, Chubb operates in 51 countries in three major regions of the world: Europe, Asia and Latin America. We have more than 350 branch offices overseas, with Chubb professionals competing locally for business of all kinds. Our international P&C business, Overseas General Insurance, wrote $13.7 billion in gross premiums through multiple commercial and consumer divisions. Our international life insurance business, Chubb Life, with an annualized run rate of $4.9 billion in gross premiums, is Asia-focused and provides protection and savings-oriented coverage for consumers.

Last year, international P&C net premiums written grew 11.4% in constant dollars but only 3.2% after foreign exchange translation. With the strongest U.S. dollar in 20 years, the negative impact of FX masked the real strength of this business, which experienced its best growth in a decade. Commercial P&C lines grew 11.8%, and since the beginning of the hard market cycle in 2019, they have grown more than 40%. At the same time, our international consumer P&C business, which experienced slow growth during the pandemic, rebounded well in ’22 with net written premiums growth of 10.8% in constant dollars.

Europe is Chubb’s second-largest commercial P&C market after North America and the company’s third-largest region overall, with annual gross premiums of $6.9 billion. Our European Group includes separate retail P&C and E&S wholesale divisions with operations in 27 countries. We have a substantial longstanding presence in the region, which spans from the U.K. across the entire European continent and also includes some parts of the Middle East and South Africa.

The retail operation writes $4.9 billion in gross premiums and serves businesses of all types in the U.K. and on the Continent, from multinational corporations to medium-size and small companies. In ’22, the retail commercial P&C business had another excellent year. Capitalizing on the hard market by providing a consistent and visible presence with a steady source of capacity at a time when other insurers were less willing to take risk, Chubb emerged as a major and trusted brand-name insurer of large domestic and multinational European corporations. Today, we insure more than 90% of the companies in the CAC 40 in France and write five or more lines of business with almost 70% of the companies in the FTSE 100 in the U.K. Earning the trust of these clients and winning business from entrenched local competitors takes time and commitment — another example of our strategic patience. Over the past three years, Chubb in Europe has grown more than 40% in constant dollars as we expanded our appetite and delivery in all key markets on the continent, including France, Germany and Spain, as well as across the U.K.

On the consumer side, the division includes an A&H business that is a leader in employer-paid group personal and travel accident insurance for employees. In the U.K. and Continental Europe, we are the leading cellphone insurer for the customers of mobile network operators, and we also have a market-leading position in the U.K. high-net-worth personal lines segment.

Our international E&S business, known as Chubb Global Markets (CGM), operates in the London wholesale market and Lloyd’s and writes $2 billion in gross premiums annually. From marine cargo and ships to airlines and oil rigs, from political risk to property around the world, CGM is a recognized leader in the market. Net premiums grew 8.3% last year. We shrunk CGM’s premiums to a low point of about $600 million in 2017 at a time when we were simply not being paid enough to generate a proper risk-adjusted return. Since then, the business has more than doubled in size.

In Latin America, we have major operations in nine countries and insure commercial customers of all sizes as well as consumers through A&H and personal lines, in sum producing $2.9 billion in gross premiums annually. After experiencing a considerable slowdown during the pandemic, Latin America resumed growing. Today, it is a very healthy business for Chubb and is, in fact, our most digitally advanced region. Our partnerships with innovative digital enterprises such as Nubank and Uber complement our strong traditional business presence in countries such as Mexico, where we are the #3 auto insurer with nearly 2 million insured vehicles, and in Brazil and Chile, the latter anchored by our long-term relationship with Banco de Chile, the nation’s largest bank.

The region returned to double-digit growth in ’22 with net premiums up 16.8% in constant dollars. The commercial team saw a steady increase in rates, with strong customer retention and new business in major P&C client segments, producing double-digit growth. On the consumer side, premiums also had double-digit growth, driven by our distribution partnerships through leading banks, retailers and digital platforms.

Chubb has had a large and growing presence in Asia for many years with both non-life and life operations. As I mentioned in the beginning, two strategic acquisitions in 2022 elevated the position of Asia for our company, making it the second largest region after North America. In July, we completed the acquisition of Cigna’s A&H and life insurance business in six countries across Asia-Pacific. In November, we received regulatory approval to increase our ownership stake in Huatai Insurance Group in China to 83.2%.

With a current annualized run rate of $9.8 billion in gross premiums, our insurance operations in Asia have more than 200 offices in 15 countries and territories, serving both commercial and consumer customers with P&C, A&H, personal lines and life through dozens of major brokers and hundreds of thousands of agents. Very few insurers have anything comparable. The region is well balanced between non-life and life, with a greater concentration in insurance revenue for consumers than commercial customers.

In 2022, Asia generated P&C net premium growth of 13.3% in constant dollars, with both commercial and consumer lines equally contributing. Commercial business benefited from favorable underwriting conditions, particularly in Australia, whereas consumer P&C growth was driven principally from activity in our large direct marketing business and our travel insurance business, where growth has picked up substantially. As China has reopened from its strict pandemic controls, this will further stimulate growth in the region; think trade, which benefits commercial lines and business travel, and think tourist travel, as millions of Chinese begin to travel again.

The Cigna life company operations, an outstanding franchise, writes predominantly A&H business and provides both an immediate boost to revenue and earnings and adds to a substantial foundation for future growth in the region. Korea — now Chubb’s second-largest country with nearly $3 billion of annualized premium — features a well-established, highly respected and extremely well-managed life company as the centerpiece, and a significant, well-run, non-life company presence. In Korea, we have a unified vision around marketing life and non-life products, centered on our massive telemarketing and consumer database capabilities, emerging digital tools, and continuous product innovation. We also have a network of thousands of agents and brokers. Our unified life/non-life vision in Korea will serve as a model for other countries in the region.

We are on track with the integration of the Cigna operations into Chubb and expect to deliver all of the value-creation benefits we previously communicated, including revenue and expense synergies, EPS and ROE accretion, and an IRR of about 20%.

As for Huatai, our increased ownership makes Chubb the first foreign financial institution to majority-own a Chinese financial services holding company, with separate P&C, life and asset management/mutual fund subsidiaries. Chubb and Huatai employees have worked as colleagues for 20 years and know each other well. We have the vision and plans to significantly grow and improve Huatai’s capability and profitability over time — we are looking at five to seven years and beyond — transforming it into a much larger, high-performing Chinese company with Chubb characteristics. To be clear, Huatai is not about short-term financial returns. We bought an incredibly rare asset with a valuable set of licenses and more than 700 branches in 28 provinces. Given the size of the Chinese economy and the country’s aging population, growing middle class and limited government safety net, Huatai represents an attractive long-term opportunity, though the risks of doing business in China are unquestionably high, including the geopolitical, in particular, the U.S.-China relationship.

Our growing Asia presence is an important component of our company’s long-term future. With a young and industrious population renowned for its work ethic, and its family- and savings-oriented culture, Asia is the region of the world likely to generate the most economic growth and wealth creation in coming decades, and we are positioned to capitalize. Today, the region accounts for more than 40% of global economic output, but only 26% of the world insurance market: China alone is the second-largest life insurance market in the world after the United States. So, the medium- and long-term opportunity is promising.

Two sides of the digital coin: company transformation and digitally native business unit

Chubb has been on a journey, reimagining our future and how we will remain vital and relevant in a digital age. This is central to both our short- and long-term strategies. We think of our digital mission as two sides of the same coin that will converge over time. On one side are our vision and the ongoing efforts to transform our businesses in a targeted way, which means everything we do in our company. On the other side is the progress we’re making in growing our digitally native business unit, which is about generating revenue and income.

We have a plan to transform our traditional flow businesses to operate as fully digital businesses. Mostly serving consumers and small commercial entities, flow businesses are well suited for total automation and other efficiencies, and they currently represent the majority of the company’s total premium. Transformation includes how we organize, who works with whom, the skill sets we employ, how we do business, the use of data and analytics, technology and our tech organization. The timeline for this endeavor is four to five years and we’re making good progress.

We have established and staffed a transformation office to lead, guide and help each division make the flip to a digital way of doing business. In our vision, our future workforce will consist of fewer but more highly skilled employees who will market, sell, underwrite and service in a customer-centric way, supported in everything by data, technology and automation. It’s all about how we do our business, our speed of change, improved insights and flexibility to adapt. In our vision, transformation will ultimately result in premium growth with little marginal cost, superior risk selection and pricing, increased speed to change across all of our functions, and radical automation, which we define as straight-through processing of 75% or more of all major processes. Our efforts to date have achieved significant efficiencies with run-rate savings projected to exceed $420 million by the end of 2023.

Turning to the other side, our digital business unit is expanding quickly in terms of revenue, products and capabilities, with nearly 200 leading digitally native platforms and financial institutions, particularly in Asia and Latin America. This business has 20 million digital policies in force and access to more than 375 million customers. If you think about what I just described about our operation in Korea and imagine these digital capabilities there, you understand why we are excited about the future. In 2022 we produced about $500 million in gross premiums through digital platforms, and in 2023 we should achieve close to $750 million with an underwriting profit.

The risk environment: staying on top of rising loss costs

Returning briefly to the current risk environment, generally speaking, loss costs rise every year. If pricing doesn’t rise at the same rate, all things being equal, loss ratios rise. Insurers’ underwriting margins have increased over the past few years, but, as I mentioned earlier, loss costs have been rising as well. We face a risk environment that is more threatening and challenging to navigate. While numerous risks are driving a rise in loss costs, three stand out: 1) CPI inflation-driven expenses such as auto repairs, building supplies and labor, which are driving property or physical asset costs; 2) social-, medical- and litigation-related expenses, which are driving liability costs; and 3) climate-driven costs from natural perils such as hurricanes, flooding and wildfires.

When inflation is accelerating, the lag time and accuracy of loss-cost data become critically important to an insurer — much more so than in periods of low inflation. Last year, we enhanced our ability to collect and assess loss-cost data more quickly and accurately so that we could react rapidly and frequently. This enabled us to be more insightful in the pricing and reserving of our short- and long-tail lines, and endeavor to stay on top of inflation. In 2022, the vast majority of our portfolio achieved favorable risk-adjusted returns, and we charged additional rate primarily to keep pace with rising loss costs.

Heightened loss-cost inflation — which, given the nature of the drivers, is likely to ameliorate in ’23 for short-tail property lines as general inflation begins to abate — will remain an industry challenge for long-tail casualty lines. Elevated loss trends are showing up in everything from auto accidents to securities class action suits, from medical malpractice and professional liability claims to sexual abuse-related reviver statutes. While the insurance market is reasonably disciplined at the moment, casualty rates in most classes will need to rise at an accelerated rate or else the industry will fail to keep pace.

A major contributor to frequency and severity of loss in casualty lines is litigation as a business, driven by an aggressive trial bar and turbocharged by litigation funding, a multibillion-dollar global investment class that allows investors who have suffered no harm to pay litigation costs on behalf of the plaintiff in exchange for a cut of a favorable settlement. Set against a backdrop of societal attitudes around social justice, anti-corporate sentiment and juries sympathetic to “victims,” plaintiff attorneys drive up litigation-related costs by testing exaggerated theories of liability and corporate responsibility.

Premium Distribution by Product

2022 net premiums written

The costs and compensation in the U.S. tort system amounted to $443 billion in 2020, equivalent to 2.1% of U.S. GDP, or $3,621 per American household, according to a recent survey by the Institute for Legal Reform. These levels are the highest since at least 2016 and have outpaced the growth in inflation and GDP over the same period. Only 53 cents of every dollar reach claimants, while the rest goes to litigation costs and other expenses — including the cut for the litigation funders. The insurance industry actively supports reform efforts, but this isn’t simply our fight, and insurers are not the most effective advocates for reform. Excessive litigation is a tax on the economy and business, and the business community as a whole must take the lead if we are to bring this back to a more rational place. Innovation and progress are impacted by an excessively litigious society, which in turn impacts economic growth.

Supporting the transition to a net-zero future

As an insurer, our business is to provide protection to our insureds, which includes supporting their resilience against the threat of a changing climate. We have an objective to help society make an orderly transition to a net-zero economy in a responsible way that does not sacrifice our energy security needs. Through our underwriting actions, we can support and encourage businesses to adopt best practices to achieve these goals. We are serious about being a leader in sustainability and continue to demonstrate our commitment with realistic, tangible actions rather than make hollow net-zero pledges that are, in my judgment, little more than greenwashing.

We appointed an expert in environmental and global climate issues as global climate officer to lead our climate-related strategies, including business and public policy initiatives. In January 2023, we launched a new climate-focused division, Chubb Climate+, that brings together our extensive technical capabilities in underwriting and risk engineering to support businesses engaged in developing or employing new technologies and processes to reduce dependence on carbon. The business presents opportunities to expand our underwriting in carbon capture, hydrogen, electric vehicle (EV) charging stations, and industrial battery storage systems that allow clean energy producers (e.g., wind and solar) to store energy for efficient distribution. Chubb is already a leading provider of many of these products and services, and in 2022 wrote more than $675 million in premium revenue related to businesses engaged in carbon reduction.

A recently announced major effort is the development and introduction of another industry first: carbon-reduction and sustainability-based underwriting criteria to assess oil and gas extraction projects that encourage our clients to limit carbon emissions, or we won’t take their risk. We are specifically focused on the capture or reduction of methane, a byproduct of oil and gas production that can be effectively managed through the adoption of controls and technologies to eliminate routine venting and flaring. This is a first step, and our underwriting standards will continue to evolve over time as we examine more areas. We are also focused on limiting underwriting of oil and gas extraction in globally recognized conservation areas. These efforts go far beyond our existing self-imposed underwriting and investing limits on coal and tar sands.

The Chubb Charitable Foundation continues to demonstrate our philanthropic support of a net-zero economy through a range of environmental causes. In 2022, the Foundation approved a grant to The Conservation Fund (TCF) to grow the Chubb Land Legacy Revolving Fund. With this additional funding, TCF can protect more acres of biosensitive lands across the U.S. that are important to wildlife and support resilience and restoration projects that aid in the recovery of damaged ecosystems.

Trade contributes to America’s economic strength

Earlier, I touched on America’s efforts to strengthen its national competitiveness. International trade has become politically unpopular in the United States. Calls for protectionism generally, and decoupling from China specifically, have grown louder on the left and the right of the political spectrum. Opening markets, including our own, is equated with others taking advantage of America, with offshoring, hollowing out America’s manufacturing sector, job losses, and favoring wealth concentration above labor interests.

This trend stands in tension with America’s tradition of leading the world in pushing forward a vision of a rules-based, market-oriented trading system. Since World War II, America’s persistent efforts to open markets in exchange for access to our own has contributed to a period of unprecedented American power and influence on the world stage. These efforts were guided by a recognition that roughly three-quarters of world purchasing power and more than 95% of world consumers are outside our borders. Our trade policy also was informed by an awareness that others were drawn to the United States in large part by the economic opportunities partnership provided. Trade policy should be viewed as a significant feature of our foreign policy.

America’s national power rests on the foundation of a strong economy. Trade contributes to our economic strength, which enables the country to invest in basic science, national infrastructure, military advancements, and social safety net programs. International trade also enables American companies to build scale, which makes them more globally competitive. America’s continued global leadership demands increased investments in these building blocks of national competitiveness. However, when it comes to trade, the United States is moving in the opposite direction. Washington is not advancing negotiations for new agreements and is not enforcing existing ones.

Global trade flows are reordering. China overtook the United States as the European Union’s largest trading partner in 2020 and trade volume between the two has grown since. A similar story applies to China’s trade ties with Africa, India and Southeast Asia. Nearly two-thirds of all countries now trade more with China than the U.S., making China the world’s largest trading power.

In Asia, two regional agreements, the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), have come into force without United States involvement. We should bind the world’s fastest-growing region more closely to our economy by joining the CPTPP. Doing so would lower American consumer prices and allow Southeast Asia to hedge against overreliance on China for its future economic growth.

As our country adapts to shifting trade patterns and reduces reliance on China for the manufacture of key inputs, it needs to regain its voice in pushing for high-standard trade agreements. The most recent trade agreement ratified by Congress, the United States-Mexico-Canada Agreement (USMCA), contains provisions on market access, services, investment and intellectual property protections, subsidies and dispute settlement provisions. This should be the benchmark for future trade agreements.

In our efforts to maintain global competitiveness, the United States has passed legislation to invest in specific sectors, such as through the Inflation Reduction Act, the CHIPS and Science Act, and the Infrastructure Investment and Jobs Act. These laws, which combine industrial policy and protectionism to benefit specific sectors and companies, privilege American companies and foreign corporations that move to our country. Our economic history shows that such efforts have failed more often than they have succeeded. Such state-led intervention betrays a lack of confidence in our market-based economic model to direct private capital where it can most effectively support innovation.

Take, for example, the CHIPS Act. The primary impediment to the growth of our domestic semiconductor sector is not access to capital. Allocating subsidies and benefits to spur construction of new semiconductor fabrication plants without also addressing the shortage of skilled labor in this sector, and regulation at every level that adds time and cost of construction, misdiagnoses root problems and will likely generate much waste and inefficiency. Similarly, protectionist requirements embedded in the Inflation Reduction Act already are damaging relationships with close allies in Europe and Asia who object to having their firms and countries disadvantaged by this legislation.

Paradoxically, as the United States has implemented new industrial policy and protectionist measures, we are encouraging a “friend-shoring” agenda, i.e., shifting supply chains to countries that are not hostile to American interests or values. These efforts are designed to ensure predictable and resilient supply chains. In the face of growing hostility with China, there is a sound logic for the U.S. to strengthen supply chain resiliency in designated critical sectors. If such efforts are used as a vehicle to advance a protectionist policy agenda, the danger is that the costs in degradation of national competitiveness outweigh potential gains.

The U.S.-China relationship

In my judgment, China’s policy direction is damaging its own interests by overplaying the role of the state in the economy. The costs can be measured in declining GDP growth rates, diminishing returns on capital, lower rates of productivity, thin capital markets, overreliance on the property sector for growth, and unprecedented levels of debt. China’s economic policy trajectory reflects Chinese leaders’ suspicion of market forces and their drive for Party control. Beijing has shown a preference for statist economic policies that allow them to direct the flow of capital and talent to state-owned enterprises and priority industrial sectors.

The jury is out on the long-term effectiveness of China’s state-guided economic policies. From a historical perspective, no country has delivered sustained growth for long by replacing the judgment of markets with that of the state, as China increasingly is doing. In these matters of economic policy, credibility is easy to lose and hard to recover. Soothing words will not restore private sector foreign and domestic business confidence and encourage investment. Only sustained, predictable, market-oriented performance will.

China’s economy will rebound in 2023, but likely not to a pre-COVID growth trajectory. Foreign and domestic capital will be cautious. China’s state-backed plans to dominate the commanding heights of technological innovation, combined with its aggressive efforts to appropriate foreign intellectual property by whatever means necessary, are generating backlash from other advanced economies. China’s large-scale military advances are sharpening international focus on the country as a strategic challenger. In the U.S.-China context, rivalry and mutual perception of threat are growing, creating a dynamic that is feeding upon itself. This trend is undermining arguments for strategic patience and managing competition with an eye toward long-term national interests.

Even with these myriad challenges, China will remain a central feature of the global financial picture for decades to come. The country is the world’s second-largest economy, its largest manufacturer, and largest trader. Notwithstanding talk about U.S.-China decoupling, the two countries set a record for bilateral trade volume in 2022, with goods trade reaching $680.7 billion.

Taiwan presents the most proximate risk of conflict for the U.S.-China relationship. Beijing has made its ambition clear that it wants to pull Taiwan into its orbit and, increasingly, is matching resources to its ambitions. Washington is improving coordination with allies to collectively deter China from using force, while at the same time supporting Taiwan’s efforts to improve its self-defense. We should, however, tone down rhetoric and symbolism around Taiwan. Supporting Taiwan as a demonstration of opposition to China does not improve America’s national security; it just raises China’s insecurity and feeds its impulses to overreact to Taiwan-related events. American policy decisions on Taiwan should be measured by clarity of objective — preserving peace and stability in the Taiwan Strait.

China is not 10 feet tall and will not rise on a linear trajectory. The country poses a challenge to America’s global leadership, but it is not predestined to emerge as an enemy or a winner. The United States maintains fundamental advantages over China, including its global network of alliances and partnerships, benign borders, a rule-of-law system, a market-based economy, a culture of innovation, abundant natural resources, and a tradition of attracting the best and brightest. These assets should afford our leaders greater confidence in our model and capacity to deal with challenges posed by China.

There will be policy focus in Washington in the coming year on shoring up vulnerabilities against China, including by limiting China’s access to technologies or capital that could be used to target the United States or its partners. This will generate greater scrutiny of U.S. technology transfers to China and of Chinese investments in the United States. It may also take form in an outbound investment screening mechanism. The more that America crafts trade and investment restrictions on China that are narrowly tailored and capable of attracting support from allies and partners, the more impactful they will be.

More important than the tactics, though, is clarity on the purpose of American strategy. China will continue to run its own race as it seeks to outperform the United States. America will need to run its race better to sustain its lead over China. Any efforts to contain China or seek to compel the collapse of the Chinese Communist Party would be self-isolating; there is not enthusiasm in other countries for joining such a coalition. At the same time, the United States must vigorously defend its economic and security interests.

Ultimately, the U.S. and China will have to establish terms of coexistence. Rivalry will be a feature, but not the only defining feature. Both countries also will be compelled by self-interest to trade and to coordinate on global threats, such as climate change and public health. Responsible leadership of major power relations demands nothing less. This means active engagement led by the presidents of each country is required. In the first instance, our leaders must meet and set an agenda that lays the groundwork for stability, conflict avoidance and a framework to begin managing our differences.

A high-performance organization with a strong work ethic

Chubb is a growing business, and we need the right people to grow with us. We aren’t for everyone, and our culture ensures a certain self-selection. We are a high-performance organization with a strong work ethic. People who do well here are principled, ambitious and set high expectations and standards for themselves — they want to be part of something bigger than themselves. We’re a place where people have confidence and pride in their work and practice their craft at a high level of excellence — from underwriting, claims and actuarial to finance, analytical sciences, and software and risk engineering, to name a few. These are the kinds of people we are attracting, grooming and retaining, and we want more of them.

At the same time, we strive to achieve a true meritocracy and an inclusive culture that provides opportunity for all, regardless of gender or race. All must feel comfortable and energized to do their best, contribute, and be recognized and rewarded. While we have made tangible progress, we have more work to do to create a truly level playing field and an organization that is blind to anything but talent, capability, the right kind of attitude and individual results — after all, it’s iterative and takes time. Chubb is a top quartile company in terms of business performance, and we strive to be a top quartile company in gender and racial diversity.

A lot has been written of late about the workplace of the future and what employees now seek in terms of their work-life balance in a post-pandemic world. While we operate in most places with a minimum hybrid 3/2 workweek schedule that provides flexibility, we are fundamentally a work-from-office company — not for all positions, but most colleagues are in the office or on the road four to five days per week. People who are committed to that reality with the requisite drive and ambition belong here; people who are not probably don’t. Companies that compete for talent by simply offering an easier life, full-time work from home, a smaller workload, and more money are hardly on a path to long-term success.

Last year, my colleagues once again demonstrated why they are the best in the business. I have many to thank for another year of record growth and accomplishment, beginning with my fellow employees and strong senior management team. I’m surrounded by dedicated, engaged and supportive professionals — amazing people who care so much about our company and their customers. We are a company of builders who want to win. Without their individual and collective sacrifice, our achievements, and the mission we are on to constantly push the boundaries as we create a great and enduring company, simply would not be possible. I also want to thank Chubb’s active and supportive Board of Directors, whose commitment and counsel have been essential to our company’s success. A special thank you goes to Mary Cirillo, a longtime director who is retiring in ’23 after 17 years of stellar service to the company, and to Luis Téllez, who joined the Board in ’21 and has decided not to stand for re-election.

Chubb is a compelling long-term shareholder value creation story. We are a leader in our industry and have a unique, well-diversified portfolio of outstanding businesses with substantial capabilities, including global presence and scale, backed by a strong balance sheet, world-class service quality reputation and sterling brand. Our product and distribution capabilities are well integrated with a disciplined, execution-oriented culture. With a presence in all important areas of the world, and clarity of strategy and opportunity, our sights are set on significant long-term revenue growth and earning power. We are confident that our best days are in front of us, and that we will outperform and deliver exceptional value to you, our shareholders, long into the future.

On behalf of the entire organization, thank you for your investment and trust in us.

Sincerely,

Evan G. Greenberg

Chairman and Chief Executive Officer

This letter contains non-GAAP financial measures. For a reconciliation to the most directly comparable GAAP measures, and related details, see pages 50-52 of the Chubb Limited 2022 Annual Report. Forward-looking statements made in this letter, such as those related to company performance, growth opportunities, economic and market conditions, product and service offerings, commitments, and our expectations and intentions and other statements that are not historical facts, reflect our current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. See page 49 of the Chubb Limited 2022 Annual Report and our filings with the Securities and Exchange Commission for more information on factors that could affect these matters.